What are we trying to achieve?

Our vision is to make the world a better place by leveraging our knowledge and skills in one of the greatest inventions from Computer Science, Bitcoin. Bitcoin technology allows for peer-to-peer payments between individuals, without the need for intermediating banks or card operators. Its smart contract capability allows for the disbursement of money under pre-programmed conditions. With this technology, we are building innovative new ways for everyone to participate in and benefit from the very lucrative financial services industry.

We want to catalyse major changes to the fundamental socio-economic inequalities that have plagued humanity for centuries. The world’s financial systems and related industries are extremely lucrative and are only enjoyed by the wealthy few. We want to help as many people as possible, who may not have been afforded the same opportunities as others, to enjoy a fairer share in that wealth.

We want to address problems you may be aware of…

Our financial systems are plagued with many legacy issues:

Nearly 2 billion adults in the world are unbanked

As of April 2018, roughly 1.7bn adults remain unbanked. The reality is that traditional banks run on expensive infrastructure (buildings, old IT systems, and so forth). It is therefore not profitable for banks to take on clients at the poorer end of the spectrum. With our solution, owning a bank account is not essential for some basic services such as sending money to your country. You will not even need a bank account to invest in Bitcoin.

Traditional banking can be expensive

While a competitive landscape and watchful journalists keep banks on their toes with regard to fees, other non-headline banking costs can be quite demanding on certain customer groups. For example, it is generally extremely difficult for young entrepreneurs to secure low-cost financing to start up their businesses. And the poor, because of their generally higher credit risk, will generally be charged higher interest rates on the loans provided to them. Phase 1 of our solution will provide peer-to-peer Bitcoin lending capabilities, but also lay down the foundations for more customisable, decentralized fiat lending functionality in future releases.

Only a privileged few have access to superior financial services

Only the more fortunate and/or wealthy who have the necessary minimum amounts of investment capital can afford expensive money managers and advisors to help them invest offshore or invest in facilities that are otherwise not available to the masses. With our solution, the same capability that has been built to facilitate offshore payments will be used to develop more attractive offshore investment opportunities for all users.

Wealth is concentrated in the big financial institutions

Financial institutions are able to take customers’ money, demand bank fees for holding that money and earn interest with it, by providing expensive loans to borrowers (who would include the very customers who deposited their money with the bank in the first place). But the customers do not generally benefit from interest on their bank deposits.

Financial institutions such as exchanges, brokerages or advisory firms are able to profit from your money, whether the markets move up or down. They are able to do this by charging either transaction fees or a percentage of assets or both, regardless of market movements. Our solution will provide those users who choose to provide payment and other services to people, with the same benefits. The difference is that users will negotiate fees and terms directly between themselves. There will be no intermediary that sets transaction or other fees between users.

Financial services are complex

Financial services and products are complex. People are forced to trust the financial advisors and would not know if the financial advice was skewed towards a product set for which the advisor would earn an income. Having to wade through different product options, understanding the different pricing options and benefits, or having to differentiate between product performance is complicated, arduous and time-consuming. We inevitably then just resort to following our advisors’ advice.

We are not venturing into sophisticated derivatives or other complex financial solutions. Our app will be user-friendly and guide you through all transactions in the simplest way possible.

This is true across various financial services, whether it is investments, insurance or banking. The first phase of our solution in particular targets cross-border payments, where intermediation is rampant. Payment systems around the world are not well integrated. Bitcoin technology is particularly powerful in this area. Bitcoin does not need banks. It does not need SWIFT. It does not depend on any traditional payment infrastructure or 3rd parties such as Visa or PayPal. Bitcoin is its own payment network.

… And those problems you may not be aware of

The majority of us are not even aware of the knock-on effects of prudential regulations that are meant to protect the integrity of our financial systems. Many of the regulations have their origins in the era of financial repression, which sought to channel as much of ordinary citizens’ wealth toward the repayment of government debt. In some countries, financial repression is still alive and well.

Many of us underestimate the negative effect of bad monetary policy, especially in a seemingly well-functioning economy. With our solution, not only do you have access to Bitcoin, which itself is currently regarded as a long-term store of value. You will also able to escape any negative impact on the value of your hard-earned money, by ‘converting’ it into a more reliable store of value in another country.

Our solution to these problems

The first phase of our solution will take the form of a mobile app that will connect you to a global user base, and will enable you to:

- Send money to and receive money from friends/family/customers/suppliers anywhere in the world;

- Do so safely and securely;

- Buy/sell cryptocurrencies;

- Safely lend bitcoins to help facilitate transactions while earning interest; and

- Grow your hard-earned (fiat) money safely and securely by earning a return from bitcoin (BTC) price fluctuations, up or down.

Please note that even though our app will allow you to buy and sell various cryptocurrencies, we do not specifically endorse or support any cryptocurrency other than bitcoin.

How does it work?

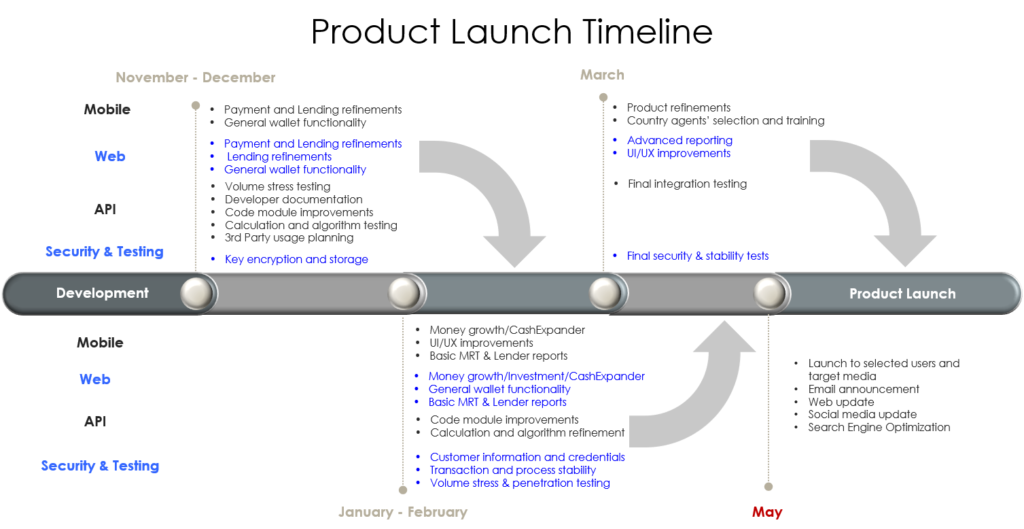

SIO currently makes use of conventional API’s to plug into an exchange with global reach in order for you to to buy, sell and manage your cryptocurrency holdings. More exchanges and peer-to-peer capabilities will be added in future. There is no rocket science here.

We have spec’d, built and tested a revolutionary capability that will allow our users to earn a return in their domestic currency based on Bitcoin price volatility. It is based on a transactional mechanism that we are in the process of patenting. As part of Phase 2, we will enable ‘plug-ins’ that will allow those of you who love trading and building trading bots, to bolster our transactional engine in order to generate even more gains for our users.

The payments module makes use of Bitcoin technology to facilitate the transfer of value between any sender and receiver, regardless of the countries they are in. It makes use of a very simple principle:

- The sender converts domestic currency into a specific number of bitcoins.

- Ownership of the bitcoins is transferred to the recipient.

- The recipient converts the bitcoins into his/her domestic currency

However, SIO uses a hedging mechanism in the background that ensures that the recipient ends up with the right amount of domestic currency, regardless of any BTC price fluctuations or differences in the value of BTC between the 2 countries. Many remittance startups have tried to use this simple principle to facilitate money transfers. However, their successes have been limited, primarily because they were not able to overcome the ‘last mile’ problem. We have.

The following video provides some insight into our app as it currently stands. We are in the process of patenting our IP. We will therefore only release more details later once the patent process is completed, and the solution is ready to be tested in full.

What makes SIO different?

SIO is more decentralized than other applications claim to be.

The most important feature of our solution is that it will probably be the most decentralized financial application the world has to date. Users will transact directly with each other, peer-to-peer. The users will determine and agree on the commercial details (the payment amount, the fees, the foreign exchange rate, etc.) of the transaction. There is no bank, payment gateway or financial intermediary involved that manages the commercial terms on behalf of the participants.

Not even our company plays any intermediary type role in the transactions. Our company does not accept any money or bitcoins, does not set the financial terms between participants, and is not the counterparty to any of the transactions. We remain neutral. All we do is manage a global system that connects users and that allows them to conduct commerce on their own terms.

Yes, there will be centralized structures such as banks and cryptocurrency exchanges involved in the process. And yes, they will charge fees for their role in the process. But for as long as fiat money remains the dominant basis for commerce, we will not be able to avoid working through these institutions entirely. And at the intersection where Bitcoin meets fiat, the relevant regulations for that jurisdiction will have to be applied. However, other typical centralized structures and systems such as correspondent banks and the SWIFT network that are used for cross-border payments, are bypassed.

You don’t need to understand or own Bitcoin to benefit from the solution

All types of users will gain benefit from our solution. Not just cryptocurrency enthusiasts. Everyone can benefit, including:

- People or businesses who need to send money to other countries, but who do not own or have no interest in Bitcoin

- People who want to benefit (in their domestic currency) from the BTC price movements, but who do not want to trade themselves

SIO works independently of the price of Bitcoin

The cross-border payments facility is completely independent of the price of Bitcoin. As mentioned above, it has a built-in mechanism that hedges away the Bitcoin price fluctuations so that recipients still receive the amount of money that they agreed to with the sender.

We are not creating a new currency

Unlike Facebook’s Libra or Ripple’s XRP, we have not created a new currency or token to enable cross-border payments. We are using Bitcoin technology for this. We will not be involved in managing the money supply of any currency in any form whatsoever. It is our every intention to stay away from all the controversial matters in the crypto space so that we can get on with the task of helping people.

What sets our solution apart from the rest?

We believe that our solution is superior for a number of reasons:

- It is based on Bitcoin, which to date is the most secure, decentralized, censorship-resistant and robust cryptocurrency network in the world.

- The success of our solution is not strongly tied to our own marketing efforts. Instead, it will be driven by everyone around the world who will use it for their own benefit. And,

- This is a solution for everyone, not just crypto enthusiasts.

Unlike other cryptocurrency networks, Bitcoin is extremely formidable, and almost unstoppable by tyrannical governments. Please read here for more information. It is for this reason that our solution is based on Bitcoin technology.

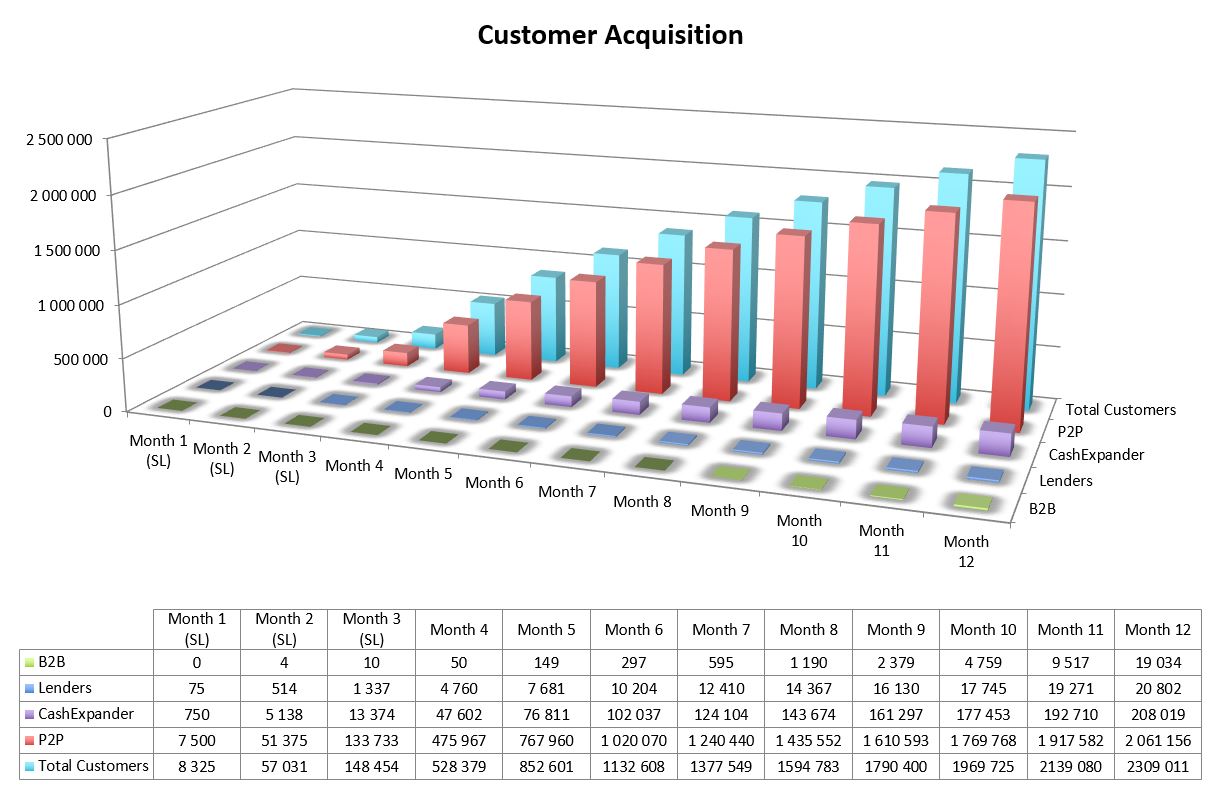

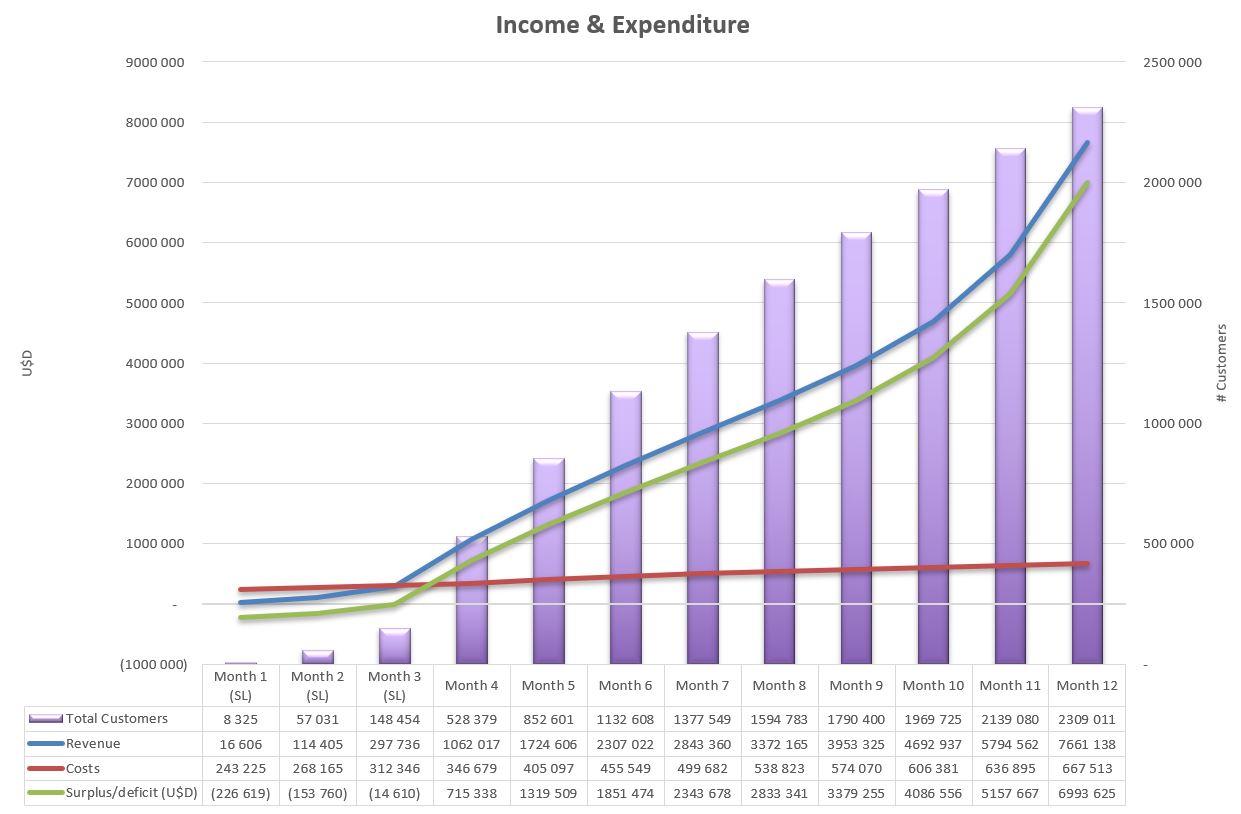

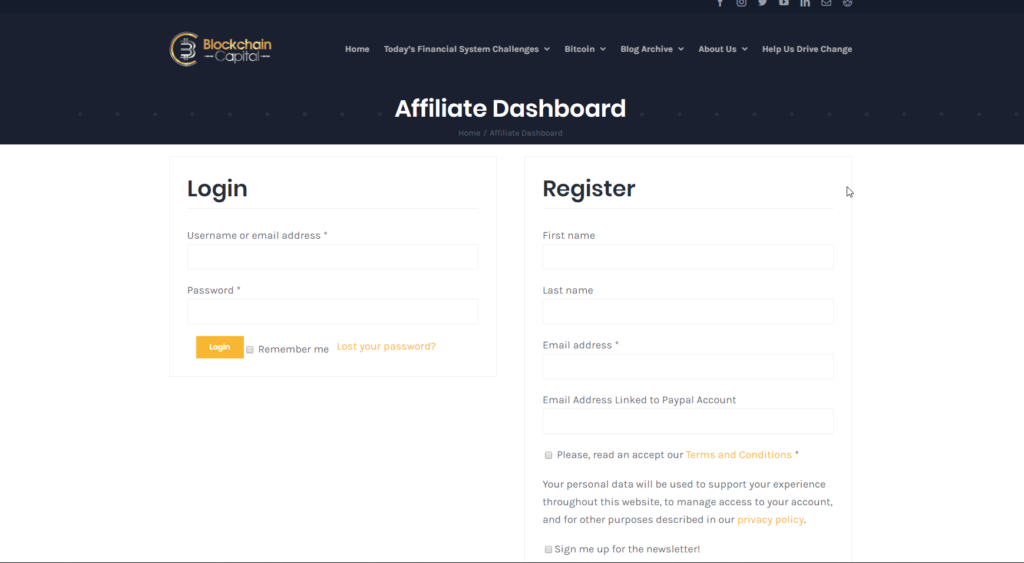

Our solution is also one that can grow virally, without our company having to market it for the long term. It has been designed in such a way that many different types of users are able to play a role and benefit in different ways, creating a stronger and stronger network on its own. Our solution will drive a network effect, where all kinds of users with different objectives can come together and create a groundswell of uptake.

Very importantly, our solution will clearly demonstrate, beyond a shadow of a doubt, how powerful a peer-to-peer network can be. For the first time, people around the world will be able to clearly identify any attempt to replicate a solution such as ours, but where wealth is being concentrated at some kind of corporate centre. Just about anyone will know when the developers of a solution are more set on their own capitalist intent, rather than sharing and generating value for everyone.

We also have a dedicated and passionate team. To see why click here.

Have any questions

Check out the answers to our frequently asked questions by clicking here

The risk-reward profiles of cryptocurrencies (excluding Bitcoin) are extremely high. Yet, ICO’s, and more recently STO’s (security token offerings) have been an extremely easy way for tech start-ups to raise capital. Unfortunately, not everyone wins in the process of buying tokens. The overall cryptocurrency market value tanked since the epic highs of late 2017, and Bitcoin dominance is now in the region of 70%. We are all too familiar with the negative stigma and challenges associated with token offerings. More than a year ago, we published an article definitively stating that ICOs were an easy fund-raising platform for companies with extremely weak business cases, and that token values would dwindle. Our prediction came to pass.

More people lost rather than gained by participating in tokens

A recent tally shows that 55% of 2018’s failed crypto projects were launched through an ICO in 2017. In another study, New York-based Satis Group LLC showed that roughly 80% of ICO’s conducted in 2017 are scams. If you would like to know more about the major class-action law-suits, this article is a good and short read.

According to the article, “a common theme in many of these lawsuits is the plaintiff’s allegations that digital tokens are securities and should be marketed in strict compliance with securities regulations in the US. Another common theme is an allegation of fraud and misrepresentation, going after original representations in the White Paper and the actual status of product development at the time of litigation.”

Token-buyers/investors have no recourse if they are scammed

We urge you to please take a look at the terms and conditions of any ICO, STO or any cryptocurrency exchange. You will consistently see that they completely absolve themselves from all risks that arise from participation in cryptocurrencies. This risk is all with you. Add to this the fact that either there are no solid fundamentals (as is the case with non-Bitcoin cryptocurrencies) or too little disclosure of the fundamentals (as is typically the case with STO’s), the risk-reward ratios, in our opinion, are just too high.

We have come so far, but regulators still do not have a good handle on how to regulate this space. As far as some regulators are concerned, “cryptocurrencies cannot be regulated because they are decentralized”. This is ludicrous. Bitcoin is the only cryptocurrency network that cannot be regulated. But it is just a matter of time before regulators get to grips with this and start holding token-issuing companies accountable. We have in fact tried to work with our local regulator in order to assist them with the establishment of their regulatory frameworks.

It is because the regulatory space is not matured enough yet, that we did not follow the route of an ICO or STO. Furthermore, we will only consider issuing a utility token mid-next year once our solution is live, has credibility and gains traction. Our vision is to have this utility token enable users to run our software on a distributed basis all over the globe, in order to generate income for those users. However, at this point, we are not ruling out any other possibilities. For example, if progress here in South Africa is too slow, we may issue a tokenized security in another country where there are rock-solid regulations with which we can comply, for your protection as well as ours.

So how is this safer?

Raising all of these issues is not meant to serve as an inducement for you to back our project. Even if you decide not to back us, hopefully, this campaign will have alerted you to the dangers of ICO’s/ STO’s, thereby having served some good. For now, we are not issuing a token, the value of which (if it gets to be traded on a cryptocurrency exchange) is determined by an uninformed public that simply trades on a speculative basis.

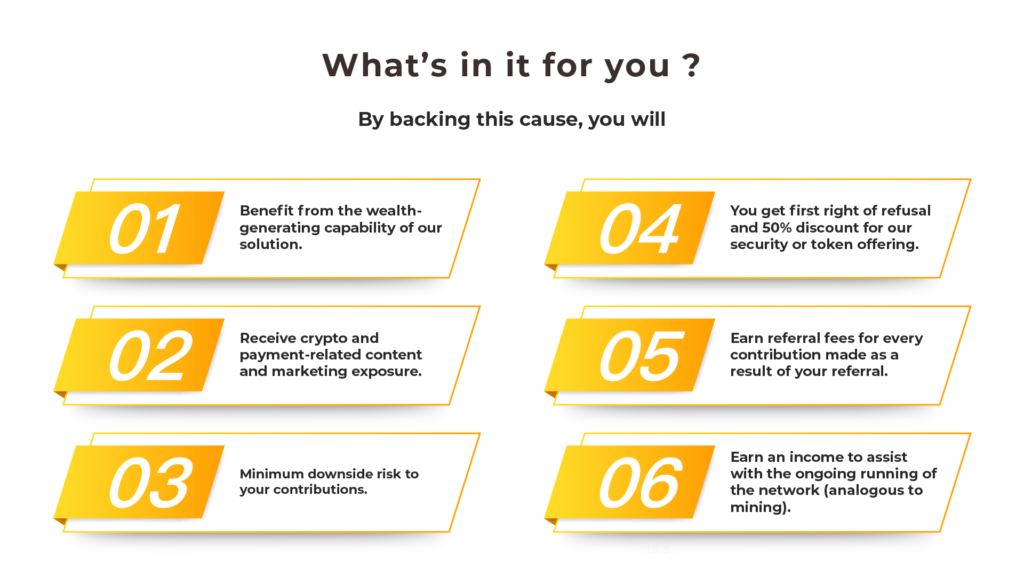

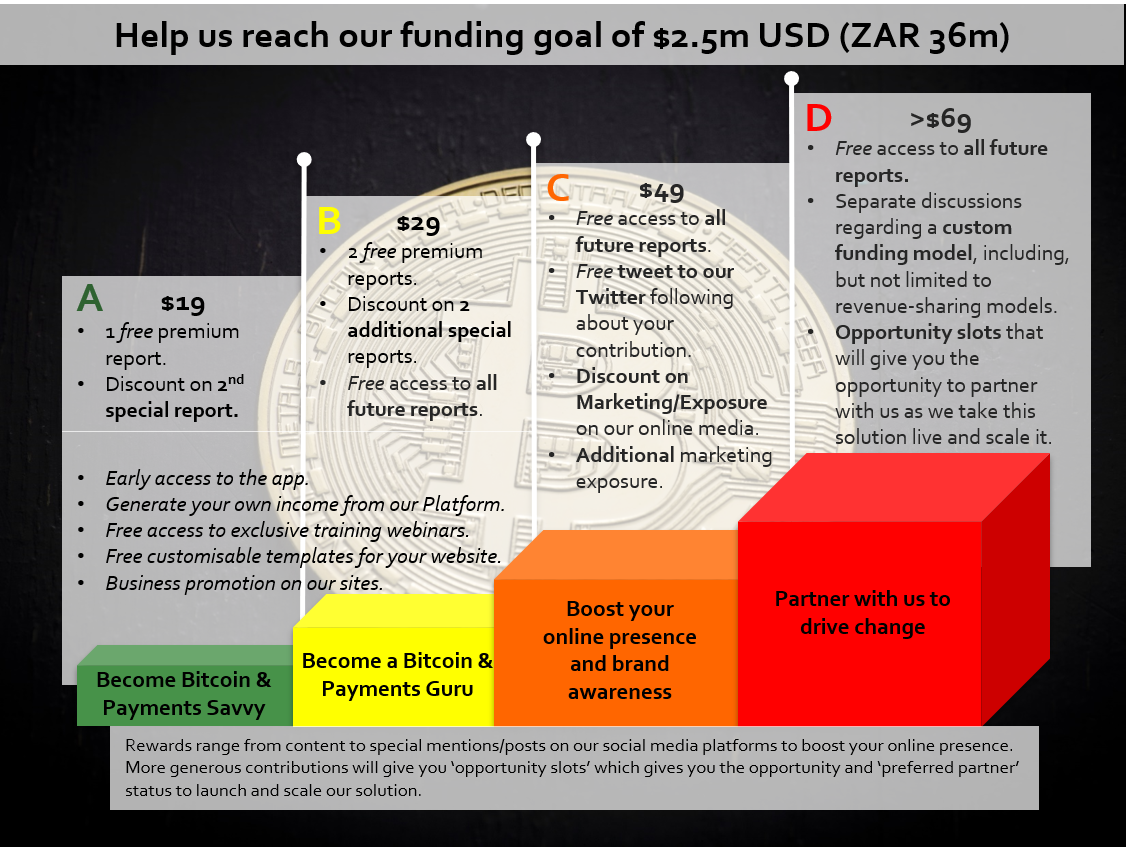

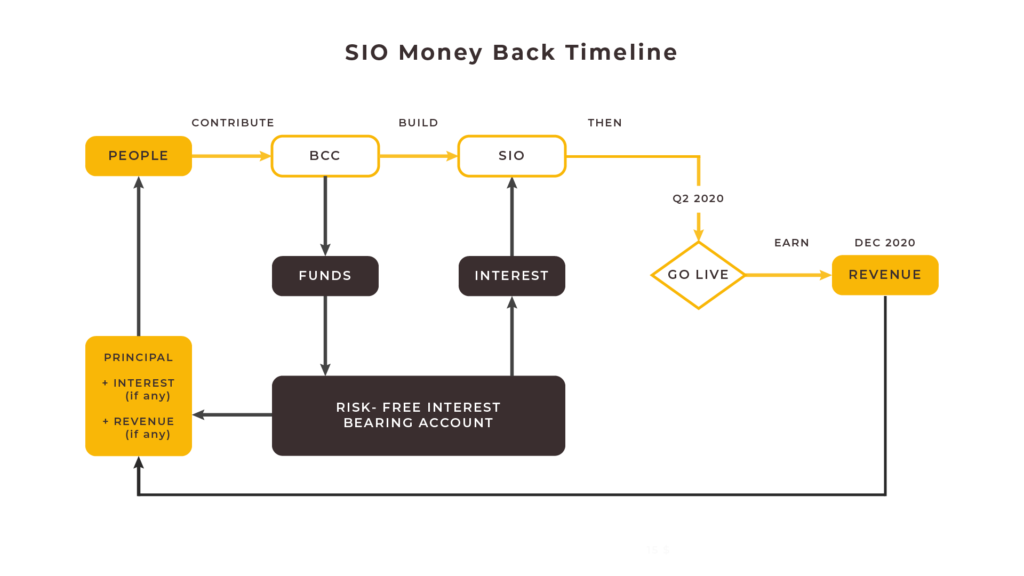

However, if you do decide to back our project, we will provide you with the following benefits in return for your contribution:

- Actual value (content, marketing, and other partnership opportunities.)

- Assurance that the downside risk of your contribution is minimised, and

- Those who have backed us during this campaign will get early access, first right of refusal and discounted pricing (at least 50%) on whatever the digital asset or security we issue in future.

In our view, therefore, the risk-reward ratio for your contribution to our campaign is much better.

Reviews

There are no reviews yet.