It is entirely possible that financial service providers can earn more from their clients’ money than what their clients do, depending on the market conditions and the particular financial products used by their customers. When the collective of all the financial service providers and intermediaries in the value chain is considered, clients lose much more of their returns than they may realise. Let’s consider a few examples.

Multiple layers of fees erode investment performance and retirement outcomes for retirees

Very few of us are concerned with or even aware of some of the operational complexities that exist behind the management of your retirement money. We simply see money being deducted from our salary each month, and expect or hope that it will accumulate into a decent amount for either retirement or cashing out when we resign.

We simply see money being deducted from our salary each month, and expect or hope that it will accumulate into a decent amount…

However, behind the scenes there are quite a few participants involved in the process, each of them charging fees for their services:

-

- A retirement fund administrator – the administrator assists with channelling portions of your monthly deductions to the different asset managers that will manage (and hopefully grow) your funds, channeling portions of your money to an insurer for your group insurance benefits, manage claim payouts and so forth;

- Asset managers – they will invest your monthly contributions into specific shares and other instruments, usually based on some form of life-stage investment strategy;

- In addition to their normal asset management fee, they may charge a performance fee if the portfolio performance exceeds some benchmark (which investors rarely understand).

- Separate (and usually higher) fees are charged for the portion of your investments that are invested offshore.

- Multi-managers – multi-managers may sometimes be involved in the management of your investments by managing the underlying investment managers who each manage certain portions of your investments. An additional multi-manager is then levied for this service.

- Platform providers – these providers have the systems and operations to give more savvy retirement fund members more choice in terms of where to invest their retirement funds. Platform fees are levied for this as well.

- Employee benefits brokers – their responsibility is to help your employer with the structuring of your retirement benefits, be the interface with the administrator, assist with educating you (the employee) about how to better grow your retirement savings, and so forth.

- Asset consultants – these consultants typically advise stand-alone retirement funds with regard to investment strategies and levy a fee for this advisory service.

As you can see, there are many participants involved in the background, and while the value that each one adds might be questionable, the fees levied are very real. It is not unusual for the total fees to add up to between 1% and 3% of your retirement savings. Perhaps these percentages look small, but they have a compounding impact on your retirement funds. It is not unusual for an additional 1% of fees to reduce your total retirement savings by 40%. The graph below illustrates this more theoretically:

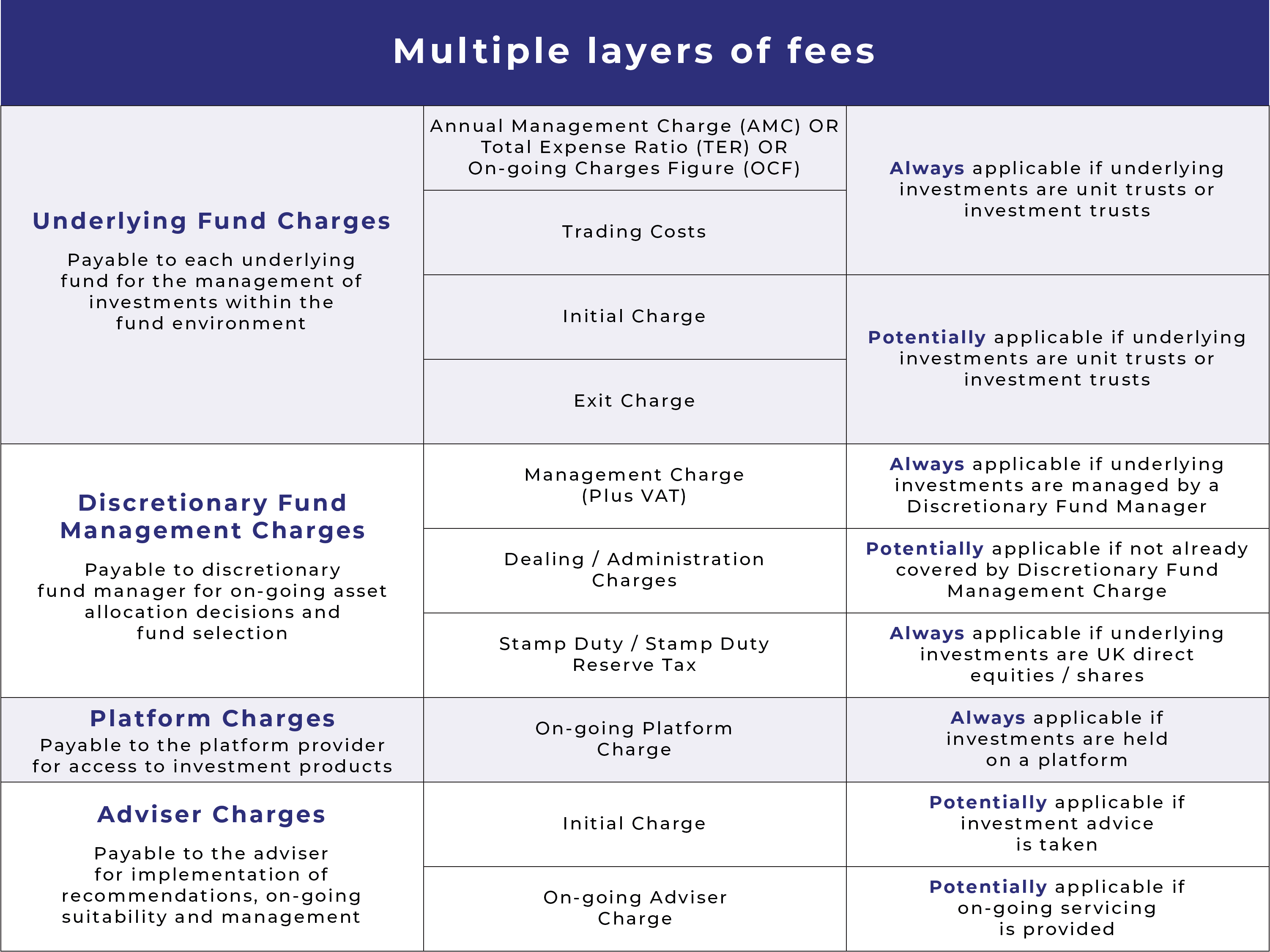

Multiple layers of fees erode investment performance of your short-term or medium-term savings

Similar to how multiple players in the value chain all levy fees for their role in the process, multiple players involved in the management of your discretionary savings also levy fees that subsequently reduce the net return for investors. These fees are usually difficult to understand or not transparently shown to investors, making investment decisions very difficult for investors. Without going into detail, the diagram below again just illustrates the many players and the different charges that you, the investor pays for:

Other considerations

When one considers the raging debates between active and passive management of funds, it does lead one to question the real value that investors gain from all those additional investment-related fees that they pay.

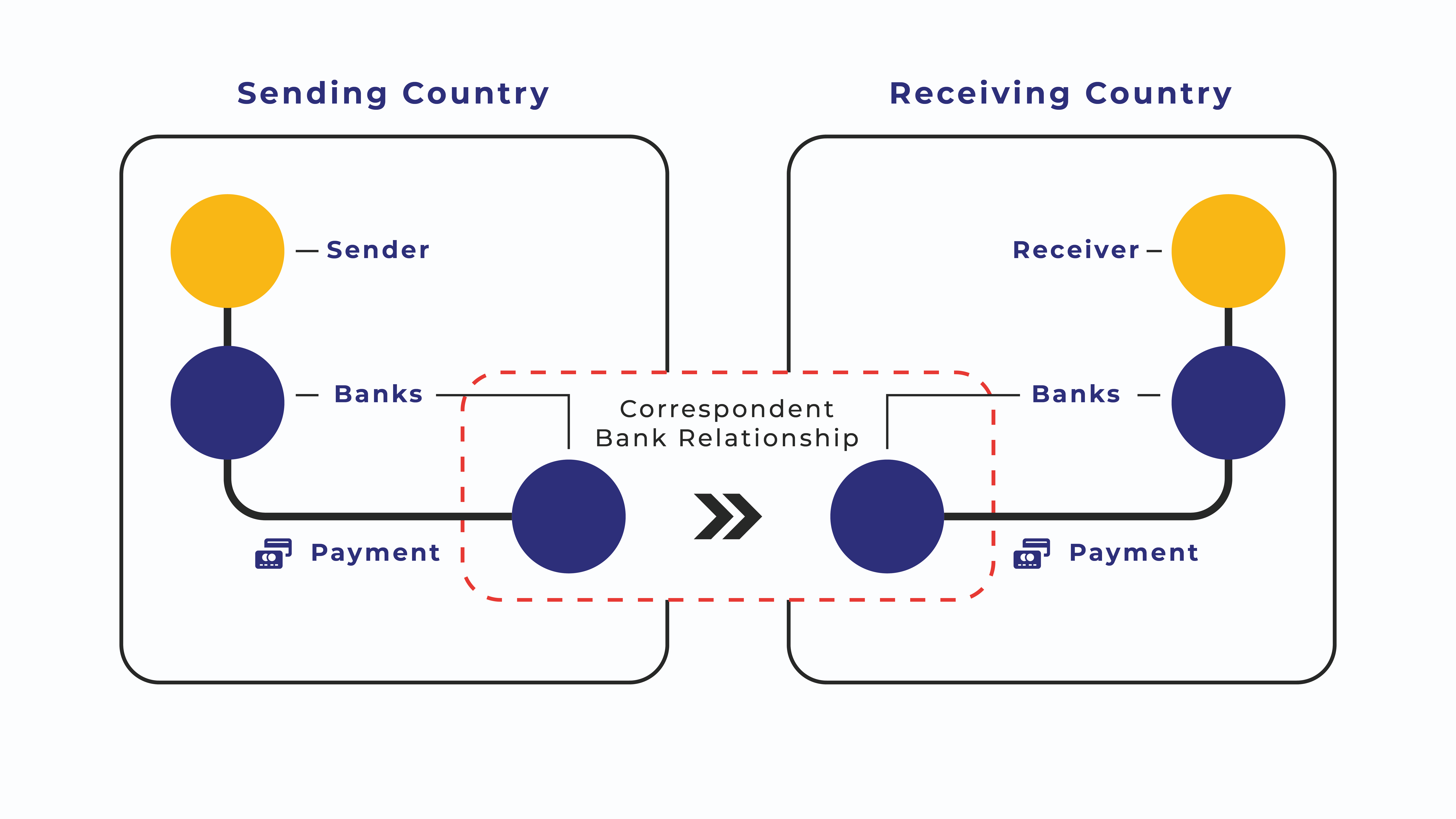

When it comes to risk-free savings such as term deposits or notice accounts offered by banks, the average investor is not aware of how their deposits are used by those institutions to lend money to borrowers at significantly higher interest rates than the interest rate that investors earn from these savings vehicles.

SIOTech World is helping to build solutions for investors to take their future into their own hands…

Is this as good as it gets?

No. It does not have to be this way. SIOTech World is helping to build solutions for investors to take their future into their own hands, without the myriad of intermediaries above who each reduce your benefit.