What the ‘experts’ are not telling you

An inordinate amount of money has flowed into blockchain startups via their token sales (ICOs) in the last year or so, way beyond what makes business sense. The vast sums of money raised via ICOs compared to venture capital funding, along with the speculative activity in cryptocurrencies, has certainly caught the attention of the media. The systemic risks that ICOs create does however not catch enough media attention.

In addition to the vast sums of money poured into the purchasing of tokens (also referred to as cryptocurrencies) before or during the ICO, the tokens themselves are now trading at prices well beyond what they were initially sold for during those ICOs. As this article will demonstrate, most of these tokens are massively overvalued, and we find ourselves in a price bubble (despite the massive sell-off in the last seven months). These tokens will eventually either disappear or undergo a severe price correction. The ICO phenomenon has effectively become an abused, unregulated mechanism that siphons money from inexperienced or uninformed investors to the token-issuers based on hype and FOMO, rather than a well-grounded fundraising process.

The mainstream public’s awareness of an impending bubble is even more scant than their knowledge of cryptocurrencies. This creates a precarious situation for existing and potential cryptocurrency investors as well as aspiring ICO projects. Unfortunately, it appears that even experienced crypto enthusiasts, cryptocurrency exchanges, ICO consultants or even blockchain consortia who are exacerbating the crypto mania, are not aware of the very real risks, and are dismissive of it as a non-issue.

Furthermore, the cryptocurrency space is an extremely divided, contested and adversarial one, with fierce technology debates continuously raging. The mere mention of the risks attached to Ethereum (discussed further below) will immediately trigger emotive retaliation rather than constructive conversations. But if the vast majority of exchange-traded tokens and a major component of the cryptocurrency market cap is tied to the success of Ethereum, it is crucial to evaluate this platform objectively.

The divisive and emotive nature of this space makes it extremely difficult for the ordinary investor to obtain the right guidance because so many different camps have their own views on the future of particular cryptocurrencies and decentralized businesses. The enthusiasm and momentum in this space may therefore continue for quite some time before the ‘bubble’ starts to deflate or burst.

It is not easy to predict how it will all unfold. A cryptocurrency such as Bitcoin for example has strong fundamentals, the longest track record, the highest credibility and is unique in purpose and function. It is the most provably-scarce, durable, border-less and censorship-resistant form of money (potentially) than any other cryptocurrency to date. We may therefore see an abandonment of cryptocurrencies in general, or a more likely scenario where a few winners such as Bitcoin emerge.

What if we viewed cryptocurrencies through a different lens?

The majority of the crypto-related material that is publicly available either has a strong focus on technology (which can become horrendously complicated) or on the financial aspects such as investments, trading and fund-raising for crypto startups. In this article cryptocurrencies (also referred to as tokens) and the tech startups to which their success is tied, will be evaluated from a business profitability and sustainability perspective.

There are so many technical specialists in this space who are constantly trying to innovate and improve the underlying technology, or ex-finance professionals who are attempting to replicate and improve the mechanics of traditional financial markets for cryptocurrencies, that not enough attention is given to the sound business evaluation of the tech startups that are issuing the tokens. Ascertaining the value of a startup requires experience in not just technology, but in running successful businesses, driving profitable market share, sales pipeline management, business strategy, customer retention, different operating models, payments, economics, regulation, and so much more.

This article is rather lengthy, so to assist you in navigating the content, here is a breakdown of the major topics that are covered:

- Where we are today — To give you a sense how quickly the crypto market has grown in a very short time and to show the tell-tale signs of a bubble

- Why the majority are unaware of or dismissive of, this bubble

- Why the risk of this bubble deflating or even bursting is real

- Where to from here

The Executive Summary of this article

For those of you who are not able to read this entire article, here is a very brief summary of what is presented:

- This article will illustrate the disconnect between the amount of money raised by the many ICOs to date and the sustainable value of the tokens to investors. The business value of most startups funded through ICOs, excluding the known scams, is weak. The associated tokens will therefore depreciate in value, resulting in financial losses to token holders or any other institution whose livelihood depends on these. The institutions that will be part of the fallout will include cryptocurrency exchanges, cryptocurrency mining companies and ICO consulting firms to name but a few.

- This article will also demonstrate how ICO platforms, along with consulting and advisory companies that are meant to guide or assist startups, are focusing on the wrong problems, to the ultimate detriment of the startup and its investors.

- Finally, a case is presented for the risks attached to Ethereum, the platform on which many of these tokens are built. Unless Ethereum fundamentally re-architects itself in a very short timeframe, the risk to the already risky tokens is severely exacerbated. There are other cryptocurrencies and blockchain solutions that are problematic in different ways, but the risks attached to Ethereum can have a much wider systemic consequence if they materialize.

- Token holders are strongly urged to review their portfolios using the information presented in this article and act accordingly. Regulatory bodies are also urged to review their policies and frameworks for ICO and cryptocurrency regulations, given the asymmetrical information at their disposal.

Where we are today

The cryptocurrency market cap has surged over the last 2 years

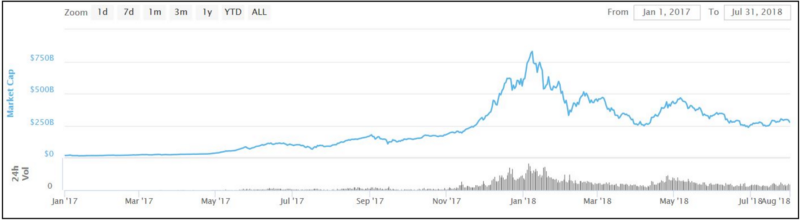

More people today have heard of cryptocurrencies because of the meteoric rise in prices during the December 2017 rally. At the peak, the total market cap for cryptocurrencies exceeded $800bn from around $15bn in January 2017. After the recent selloff, the market cap is now around $200bn USD. This may seem small (the Nasdaq market cap is around $11 Trillion USD for example), but consider that this is mostly retail money. See the graph below (courtesy of www.coinmarketcap.com):

Large amounts of money was poured into ICOs

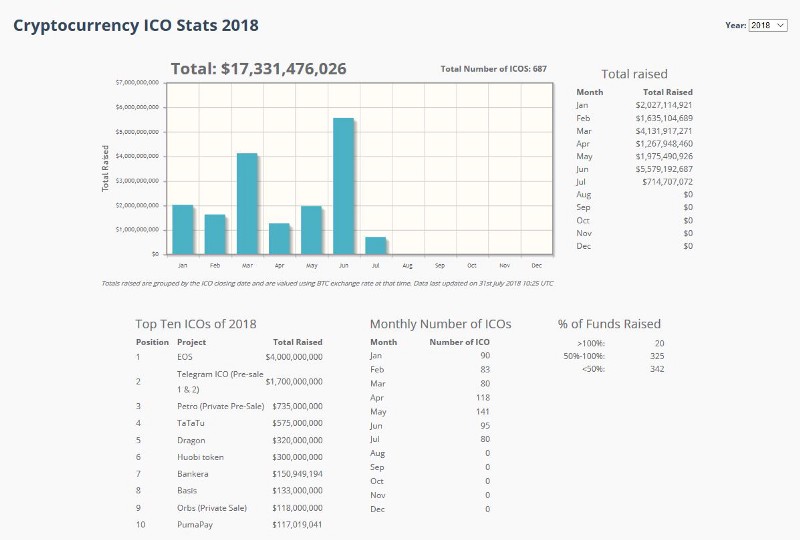

The statistics for money flowing into ICOs is equally staggering. The statistics are tricky to interpret because different sources report them differently. To keep it simple, if you group the total ICO funds raised according to the month when the ICO token sale ended, then as much as $17bn has been raised by the end of the first half of 2018! This is a little misleading as the likes of EOS had a year-long ICO process, but the point is that an enormous amount of money flowed into startups in a short timeframe, especially considering that it is predominantly retail money. The table below, courtesy of www.coinschedule.com, illustrates this.

It is concerning that so much money flowed into these tokens long before the blockchain startup even had a live business that is powered by these tokens.

The extent of the fallout if cryptocurrencies crash

Since the advent of Bitcoin in 2009, the number of different industries and companies that emerged in order to capitalize on the opportunities in cryptocurrencies is surprisingly high. Cryptocurrency exchanges (of which there are hundreds), cryptocurrency mining operations (of which there are thousands), consulting firms, institutions that offer blockchain-related courses, smart contract auditing firms, and companies manufacturing the specialized hardware for mining are just a few examples. On top of this, major corporations such as IBM, Accenture, Microsoft, Amazon, Intel, Cisco and others are building enterprise blockchain related solutions and services (the business case for enterprise blockchains is weak at this point in time, but that can be the subject of another article). Even traditional asset managers and hedge fund managers are slowly dipping their toes into the murky crypto waters.

The reason for highlighting this is to illustrate the extent of the potential fallout if the risk of a cryptocurrency crash is real and eventually materializes. It will not only be retail investors that will be negatively impacted, but professionals and businesses involved in cryptocurrencies as well. There are those cryptocurrency experts who draw parallels between the “ICO hype” and the IPO hype that preceded the dotcom crash. These parallels are indeed well-founded. It was only with hindsight that business cases for these dotcom startups were recognized as weak. The same narrative is playing out right now. Furthermore, the majority of the investors in and owners of blockchain startups that are raising capital via ICOs, either were not exposed to the dotcom crash, or witnessed it without suffering financial losses. We might therefore repeat the same mistakes.

Why many are unaware or dismissive of this bubble

It would be natural to ask why this issue is not more widely publicized or top of mind if it really is such a serious risk. Or one could ask what everyone else is missing if the content in this article is to be trusted. In this section, we’ll cover three main areas that attempt to answer these questions:

- The cryptocurrency space is dominated by technology and finance professionals, and not enough all-round business professionals.

- The cryptocurrency space is an adversarial and divided one where knowledge is asymmetric, making it difficult to make sense of everything.

- ICO advisors that we are dependent on to make sense of the chaos, are generally focused on the technology more than the long-term business viability, and did not experience the pain of the dotcom crash.

The cryptocurrency space is a finance and technology-led one

The cryptocurrency and ICO space is dominated by technology and finance professionals, and so naturally that is where most of the mental attention will be. You will often hear the more public figures talk about the “rabbit hole” they plunged into after becoming acquainted with crypto. There is a natural tendency for one’s mental focus to be directed towards this intriguing technology and its potential impact on the future, rather than thoroughly and objectively valuing the long-term sustainability of the businesses emerging in this space. The result is that the notion of a bubble or potential crash is not top of mind for most people going down this rabbit hole.

It would not be too far from the truth to say that the cryptocurrency space is strongly driven by developers and technology-oriented professionals. All the publicly available learning material and all of the ICO valuation methods have an extremely strong technology focus. The brain power, IP, training material, culture and mentality of the crypto community is dominated by technology. There is a strong focus on the developers of solutions, and not enough focus on the customer, the customer value proposition or the critical evaluation of the long-term profitability of the startups.

In addition to the developers, there are professionals with a background in financial markets, trading, investments and funding in this space as well. It is clear that the mechanics of traditional financial markets are being replicated for cryptocurrencies. This brings with it another dominant mindset in the world of crypto. It is a financially-oriented mindset where efforts to do more ICOs, list more cryptocurrencies on exchanges, create more exchanges, create custody solutions and improve trading platforms are the focus. Again, this type of mindset is less likely to include the robust evaluation of the real-world value of the tokens and the long-term sustainability of the businesses powered by them.

The cryptocurrency space is a divided one and is beset by asymmetric knowledge

Simply follow the crypto-related conversations on Twitter or articles on Medium to see the extent of the divide and the emotional bickering between camps. The cryptocurrency community is divided into cult-like followers, leveling emotive insults against each other’s cryptocurrencies and underlying technologies. Confirmation bias (where we embrace information that confirms what we would like to be true or feel emotionally invested in and reject information that casts doubt on it) is rife in this industry. So when each camp is of the strong view that their solution is better than the next (for example, Bitcoin vs. Bitcoin Cash, or EOS v.s Ethereum), naturally the mentality among all the factions will be one of ‘Our solution is great! Better than the rest.’, rather than ‘Oh no! This is not going to work out’.

Not only is this space conflicted in terms of what value propositions are brought about by what tokens, but the information available to potential investors is problematic as well. The white papers for the different startups are aimed at technologists and focuses on technology. Business evaluations for the different startups are not always available. Publicly available information can be ambiguous and other much needed information is not freely available.

How does the ordinary investor wade through so much technical material, consider so many conflicting perspectives and then make sense of all of it all to make informed investment decisions? This is extremely problematic. With all this asymmetrical knowledge and hype, how can any investor get a sense of whether we are in a bubble or not?

The mentality in the crypto sector is concerning given that emotion and sentiment drives so much of the activity. So, when the CEO of Binance is quoted as saying that ICOs are not only a positive phenomenon but a necessary one, it further fuels the sentiment that developers and entrepreneurs are entitled to less cumbersome access to more capital for their startups. Many blockchain startups are of the view that ICOs have harnessed a technology that has provided opportunities previously unseen, and that has allowed “regular people to become venture capitalists”. Positive emotional sentiment around ICOs is very strong, and young entrepreneurs feel that they have liberated an industry that was previously the domain of the ultra-wealthy. Again, with this type of mindset, why would the possibility of a bubble even come to mind?

The emotive state of the crypto space becomes palpable when industry titans such as Warren Buffet or bankers like Jamie Dimon publicly refer to cryptocurrencies as “rat poison squared”, or refer to the people who invest in it as “stupid”. Crypto enthusiasts will publicly retaliate by labeling the likes of Warren Buffet as a dinosaur that is so old that the Internet was not around when he left high school.

Some pro-crypto millennials blame these extremely well-paid bankers for their greed and poor lending practices that culminated in the 2008 crash, of which they were the victims. Bitcoin supporters see it as a weapon against governments’ monetary sovereignty, or central banks’ abilities to print money at will.

Crypto supporters will publicly engage in debate with economists about Bitcoin as a superior form of money compared to fiat currency or gold.

There are also the ‘decentralization enthusiasts’. These are those who are massively in favor of decentralized business models, which are meant to disintermediate massive corporates (Facebook, Uber and Airbnb are usually cited as examples) who profit disproportionately to the rest of society.

ICO Advisory firms are more experienced in technology and finance without the necessary business acumen

There are some credible consultants and investment managers in the cryptocurrency space who will advise/assist their tech startup clients through an ICO, or guide/manage their clients’ holdings in cryptocurrencies. For example, the valuations from Multicoin Capital are generally very professional and well thought through. However, their valuations (and those of others) usually have a strong focus on the technological advantages of the solutions, which is reflective of the overall mindset in this sector. Valuations can be improved upon by placing more focus on the long-term sustainability of the businesses powered by these tokens. If this is done, a different set of recommendations would likely follow, as will be expanded upon below.

The makeup of many advisory teams around the globe is generally weighted towards engineers, computer scientists and other ‘hard science’ professionals. So for example, when a firm such as The Element Group evaluate the investment potential of a new startup, they would offer the usual guidance such as making sure that the teams are not looking for a problem to solve using their blockchain tools, which is a good thing. This is not enough though. Other advisers, using their previous fundraising experience will assist startups to run successful ICO’s. Others, such as ICO Mission Control by Quoine, are building platforms to facilitate a simpler and smoother ICO process that is currently rather cumbersome. The technology bias of some of these advisory firms is so strong that they will even market their AI capabilities as a competitive advantage that ensures their clients get the best investment returns from their crypto holdings. These are examples of where the ‘experts’ on whom so many of us rely on, are focusing on the wrong problems. The technology alone will not ensure success. The fundamental long-term sustainability of the business takes second place in the race to capitalize on the ICO phenomenon.

The kinds of issues that advisors and investors need to challenge more than the technology include:

- Has the market demand for the product been thoroughly assessed and validated?

- How big (actual numbers) is the market for this product, now and over the next 5–10 years?

- Who are the competitors? What are their unique value propositions? What are their strengths and weaknesses? What will be the unique value proposition to fend off these competitors once you are live?

- What sales and distribution strategy and tactics will be adopted to drive take-up? This needs to be detailed and include sales volumes, by distribution channel, for each at least every 6 months over the next 3–5 years. Just having a strong team of developers and engineers is not going to sell your product.

- What are the customer volumes, revenues and cost projections (in detail) over the next 3–5 years? ICO valuations tend to steer clear of this aspect, because it is too difficult to estimate. This cannot be an excuse. If it was easy, anyone could do it.

- How much of the money raised through the token sale will be used for marketing the product or value proposition? What will be your marketing tactics and what do you anticipate your marketing ROI to be?

- What techniques will you adopt to drive customers from their current service providers to your offering? Or to stimulate demand from new customers? etc.

It is more important to ask the above questions, than to assess a token on the merits of its technology. Answers to the above questions, or at least an attempt to answer the questions will provide more clarity about the long-term sustainability of the startup. This however has not been the approach to date. This is one of many reasons why these startups are unlikely to succeed. Furthermore, virtually everyone in business today knows that it is more important to have a customer-led strategy than a product-led strategy. The tech startups are predominantly taking a ‘product push’ approach. Unless you are seasoned in the running of a business in a competitive environment, you will not understand how difficult it is to change customer behavior or get them to switch to your solution from that of your competitor. You will not understand how difficult it is to optimize you marketing ROI given all the marketing clutter out there. You will not understand how to optimize your sales and pipeline strategies to drive customer take-up and sales volumes of your solutions. Very little of this business-related thinking is or was taking place in the ICO space. As traditional or outdated as this may appear to the newer generation of startups, these are essential basics without which businesses are unlikely to flourish.

Why the risk of this bubble deflating or even bursting is real

In this section, we will focus on:

- The massive disconnect between the amount of ICO funds raised and the real-world value of the start ups

- The risk associated to Ethereum, the underlying platform

- The risk of a regulatory clampdown

The disconnect between the amount of funds raised and the long-term value of the startups

There is a massive disconnect between the amount of money that has been raised during ICOs, and the real business value that the majority of startups will eventually generate. Some poignant examples that illustrate this include EOS and Telegram, who each raised around $4bn and $1.7bn respectively. This staggeringly large amount of money was predominantly funded by retail investors and was done before the startup was even able to build a track record or to demonstrate real business value. What kind of amazing business plan was presented to the investors to justify this amount of investment?

On average, you will find that decent business plans for ICOs are scant to non-existent. It is not enough to see a very thorough whitepaper, but complementary information such as a market gap analysis, competitor analysis, SWOT analysis, a financial model, wallet design, and more as described above. Many potential investors look at the white papers, the teams behind the startup, or listen to other ‘experts’ to decide on whether to invest. This is where the parallels between the dotcom bubble and the ICO bubble have merit. Back then, just because businesses or startups had a website, their valuations skyrocketed despite the fact that there was no solid business case to justify such high valuations. Similarly today, just because a business is built on a blockchain, it’s value becomes irrationally high.

Let’s consider just a few random examples of tokens. These were chosen because information about them were readily available, and for no other reason:

- EOS

- Augur

- Golem

Let’s briefly look at these individually.

- EOS

By June 2018, EOS raised roughly $4.1bn, but it only went live around the same time. This is a massive amount of money for a startup that did not even have a minimal viable product. At the time of writing, the daily active user count for the last month is only 32!The EOS whitepaper is rather technical and has no go-to-market strategy or answers to the above questions. Multicoin Capital produced a valuation report which was reasonably thorough. The report rightly points out the fundamental weaknesses of Ethereum, which is also elaborated upon below. It also makes some consideration for the competitive landscape. However, it too was unable to answer the fundamental questions about the long-term business sustainability of this business. A quote from the report supports this view: “Attempting to value EOS is much different than trying to value other projects. In our valuations of projects like Augur and Factom, we were able to construct clear valuation models based on a net present value (NPV) model or a supply and demand equilibrium model, respectively. With EOS, this is simply not feasible given the underlying token mechanics. The EOS model is unique among all token models.”.

There were many other issues with the year-long ICO process for EOS. This is a separate issue to the theme of this article, but is mentioned to raise awareness of additional shenanigans in this industry and the additional (but unknown) risks that investors are exposed to, beyond the disparity between the funds raised and the actual business value.

- Augur

Augur’s token sale took place between August and September 2015 and raised $5.3m USD. But the solution only went live mid-2018. The amount is not as extreme as EOS, but it is still a massive amount of startup funding for what essentially was a concept. The whitepaper is EXTREMELY complicated, technical and mathematical. How would an investor be able to make an investment decision on the basis of this paper? And at the time of writing, Augur has less than 30 active daily users!

The Multicoin Capital valuation rightly raises the risk that “the success of Augur as a user-facing application is directly tied to the success of Ethereum”. The report also included some financial modelling which is good. However, the underlying sales, marketing and distribution strategies that would enable the projected numbers to be reached are absent. Surely this is not enough to provide a savvy investor with confidence that the targeted projections will be reached? The underlying costs for the application will also be impacted by the (in)efficiencies of the Ethereum platform, which also adds to the risk of this investment.

An additional side-note regarding Augur, is that the original developer of the idea, who is fairly well respected and credible, does not agree that the way Augur was built will ensure its longer-term survival. Again, this is separate to the central theme of this article but is also mentioned to raise awareness of the controversy and conflicting views in this space. This makes it extremely difficult for ordinary investors to make sound decisions.

- Golem

Golem conducted the sale of its tokens in November 2016 and raised about $8.6m USD. However, the first phase of the solution only went live in April 2018. The final phase of the solution is currently estimated for late 2020. Again, this is similar to the previous examples where large sums of money were secured for a technical concept without a proper business case.

This particular white paper was interesting though. It actually had a go-to-market (GMS) strategy along with a roadmap for how the solution would be rolled out, which is a great start. However, the GMS is extremely light, and focuses more on developers than the end user. There is no robust analysis for what the anticipated market demand for this offering would be. And if there is a market for it, at what sorts of price points? It should therefore be no surprise that in the last month the daily active user count is just above 200.

Closing remarks…

The majority of the businesses that are funded via ICO’s follow normal business models, and from a practical perspective do not even need to be built on top of a blockchain. The desired decentralization and censorship resistance comes with many other disadvantages that reduces their ability to compete with normal, centralized business models. It is very different to Bitcoin where something new, that never existed before was created, namely trustless peer-to-peer payments. The bitcoin token is intrinsic to and necessary for the functioning of the network. Bitcoin was a significant advancement to the state of payments and introduced utility that was not practical without the token. Furthermore, this utility was enabled solely by the token and its value is not tied to the fortunes of any particular company or foundation. Most ICO startups however, are not creating new utility. Rather, they are forcing ‘square peg’ cryptocurrencies and blockchains into traditional ‘round hole’ business models, and the value of these tokens is tied directly to the success of these firms. The proper valuation of these businesses therefore cannot be ignored.

The valuations for theses startups are extremely ambitious considering that for the most part, they do not have functional products or significant business and industry experience. ICO investors are simply blinded by blockchain technology and are paying a premium for companies that may be run by very smart but unproven teams. Blockchain technology, ICOs and tech startups are not immune to fundamental economics. These tech startups are entering existing markets (possibly with established competition) that can be run more profitably on a centralized basis, and they will be at a significant competitive disadvantage to these firms. The technology alone will not ensure success. You need consumer adoption, at scale, at the right price points and you need to have savvy to fend off competition.

There are clearly speculative profits to be made by buying tokens during or before the ICO and selling them before the company begins operations and real-world economics take effect. In the long run though, the value of almost all these tokens will be driven to zero.

The risk associated to Ethereum, the underlying platform

As of today, Ethereum faces major challenges that will have to be overcome before it can establish itself as a mainstream platform for distributed computing and other token economies. These challenges include those associated with its underlying technology, its economic/business model, its role in enabling potential security tokens, and its enablement of weak business models via ICOs. These will be outlined below. It is important to take a step back from all the sophisticated technology, hype, exciting use cases and potential disruptions that blockchain-based solutions proclaim, and instead look at the big picture and critically examine the fundamentals.

The reason for focusing on Ethereum is not to compare it to other blockchain solutions, but because of the large number of exchange-traded tokens that are built and run on its network. More than 90% of the top 100 tokens by market cap are built on Ethereum, and more than 80% of the top 800 tokens are built on Ethereum. So, while there are technical issues with other tokens, the challenges with Ethereum can have much wider systemic consequences if not they are not overcome soon.

- Technological Challenges

For all intents and purposes, Ethereum came into being by attempting to improve on Bitcoin’s capabilities. For example, it enabled faster transaction processing times and extended the smart contract functionality available in Bitcoin Script. It also attempted to become the general purpose blockchain upon which other blockchain-type solutions could be built. Vitalik very eloquently describes the intent in this video:

Unfortunately, this also created challenges for Ethereum. Extending Bitcoin Scripts functionality and creating a Turing-complete programming language increased Ethereum’s attack surface and made it more vulnerable to attacks, as was seen in the DAO Hack. Ethereum also had to go through a number of unplanned hard forks, including the ‘EIP-150 Hard Fork’ and the ‘Spurious Dragon’ hard fork to reduce the denial of service attacks that took place in September and October 2016.

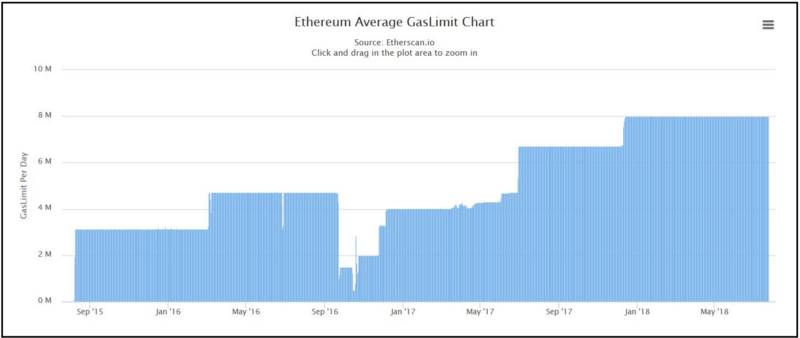

Executing thousands of smart contracts’ code on each validating node is also processor-intensive. At peak capacity, the network is perceived to take severe strain in that pending transactions (backlog) increase and the performance of ‘low fee’ DApps degrade. There are well-known examples such as the Bancor ICO and the Cryptokitties popularity surge which caused massive congestion issues for the Ethereum network and saw frustrated users demanding that the block gas limits be raised.

It appears that most of those involved in Ethereum recognize the need for the platform to be re-architected. But attempting to re-architect a live, multi-billion dollar network that is running many live DApps is risky. The proposed changes are themselves untested. Transitioning to Proof-of-Stake and sharding may not be sufficient. The development community is hard at work to address these base layer scalability issues, while others are working on various Layer 2 scaling solutions such as state channels, Plasma and Truebit. This is very commendable, but as at the time of writing this publication, Ethereum’s technical challenges are very concerning.

Let’s delve into some details.

It is a platform for executing decentralized smart contracts

One of the fundamental reasons for Ethereum’s existence is its ability to facilitate the processing of smart contracts on a decentralized network of computers (nodes). This enables peer-to-peer (no middleman) transactions and the exchange of value beyond just currencies. This means that each and every node (or fully-validating node to be exact) on the network is required to execute and validate the code on everyone’s smart contract before a block can be validated and added to the chain. As more smart contracts are loaded onto the platform, the more processing power is required from nodes. The number of fully-validating nodes are therefore decreasing (the computing power available cannot cope with the increased demand), weakening the decentralization objective of the platform.

The estimated number of nodes on the Ethereum Mainnet has reduced from roughly 30,000 in January to around 14000 today. The most reliable website that attempts to estimate the number is https://ethernodes.org/network/1. However, it does not differentiate between different types of nodes. This makes the proper assessment of the situation very difficult.

An important point to take note of is that when the total node count of the Ethereum network is being quoted on a website or report, that the different types of nodes be clearly indicated. This is because the overall node count may well be increasing, but the important metric is the number of fully-validating nodes, which needs to be increasing as well for the system to remain decentralized.

Furthermore, the cost of the parallel-processing of all these smart contracts also becomes excessive (transaction fees are discussed further below). Smart contracts on Ethereum also have a larger attack surface, and Ethereum has been subject to a number of denial-of-service attacks to date. Having said that, a reasonable repository of known attack vectors and preventative techniques is maintained on Github. Smart contract developers are also becoming smarter by moving more computational complexity off-chain.

The Ethereum state is rapidly increasing in size

Ethereum nodes (full-archiving nodes to be more specific) need to maintain the entire state database from the beginning of Ethereum (starting with the genesis block), in addition to the blockchain itself. As a result, the total space requirements for a node to maintain this data increases rapidly with time, and the total space requirement has now exceeded 1TB (1000GB). This makes the syncing of new nodes with the network very difficult. It is common knowledge now that if you try to sync a full-archiving node on a machine with spinning disk drives, it will not catch up to the tip of the blockchain. You need to have a solid-state device to run such a node, along with excellent bandwidth. Many users have reported not being able to ‘catch up’ with the blockchain, because while they are syncing, more blocks are being created.

Solutions to the disc space issue include pruning and checkpoints. However, if (or when?) block gas limits (see below) are increased, it will still put more processing strain on validating nodes. Anecdotally it appears that more Ethereum nodes are ‘downgrading’ to what are called light nodes, as light nodes do not need to hold state data. This has several unintended consequences:

- The trend towards fewer fully-validating nodes and full-archiving nodes on the network reduces the degree of decentralization. Interestingly, it was on the basis of Ethereum being decentralized that William Hinman from the SEC did not view it as a security. Contrary to common belief, it is decentralization that gives the blockchain its immutability, not the cryptographic linking/chaining of the blocks. With reduced decentralization, the immutability of the Ethereum blockchain is weakened.

- Light nodes do not participate in the real-time validation of blocks being added to the blockchain. Since it is entirely possible to create valid block headers even if transactions inside the block are invalid, light nodes would not be able to detect this. Only fully-validating nodes will. Fewer validating nodes reduces the security and trustless nature of the platform.

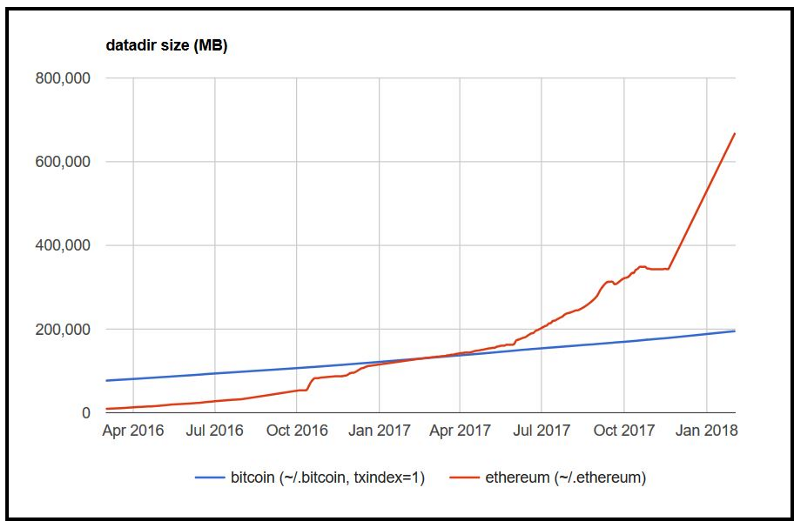

Here is an outdated chart showing the growth in the size of Ethereum’s space requirements versus that of Bitcoin:

Finding updated charts is a challenge (unless you are willing to set up and run your own full-archiving node). Consider this though: The Bitcoin blockchain has been in operation since January 2009. Ethereum only went live in 2015, and already its space requirements are significantly higher.

The block gas limit and incentive mechanism at the protocol level creates conflict

Miners of transactions on the Ethereum network can choose which transactions they mine, based on the amount of profit it will generate for them. The cost of processing or running computations is measured in a unit called ‘gas’. Users that require a smart contract to be executed or a payment to be processed, will specify a maximum amount of gas (a gas limit) as well as the transaction fees (gas fees) that they are willing to pay the miner for executing the transaction and adding it to the blockchain. The gas fees will determine which transactions the miners prioritize. The more a user is willing to pay, the faster it is likely to be processed. Visit https://ethgasstation.info/index.php for more details.

Unlike Bitcoin for example, where the block-size limit is specified in bytes, Ethereum’s block-size ‘limit’ is specified in units of gas. This size is dictated by the miners, primarily based on the economic incentives, but other factors as well. In the case of Bitcoin, with a set block size that does not increase, it becomes easier to run a node as technology improves. The total node count is therefore unlikely to go down over time compared to Ethereum. Having no hard cap on the block size at the protocol level and allowing it to increase over time has the potential to separate nodes into ‘power groups’, where the advantage is skewed towards the more powerful mining nodes. The powerful miners will have the processing power and bandwidth to dominate the rest by force, by making their mining income more sporadic. If the total blockchain (datadir) size increases at a faster pace than what technology improves, this challenge is exacerbated, further weakening the decentralization of the network.

Miners have the ability to vote on what the ‘block-size limits’ are. Fully-validating nodes that do not mine do not participate and have no say in this process. They are dependent on the miners and therefore their processing requirements are at the mercy of the miners.

Anecdotally, Ethereum users are still experiencing peer connection issues, because the fully-validating node count keeps dropping, and “good” peers that serve (seed) sufficient amounts of data are less available. Furthermore, if the block gas limit keeps increasing over time because there is no enforced hard cap at the base layer, it will place even more strain on these limited nodes and further reduce the number that do exist.

Ethereum therefore has the following potential conundrum:

- If the blocksize gas limit is not increased, there will not be enough ‘gas room’ in each block for all the additional contracts and transactions (assuming more DApps are built on Ethereum), and a bidding war will begin that will drive up fees. In other words, users that need contracts to be executed and validated quickly will have to pay more for this. If fees increase too much, basic contracts start becoming too expensive to execute timeously, and DApps that pay low fees slow down to a halt. This has happened before and Ethereum miners were forced to raise the limit.

- If the gas limit is raised, then the already reduced validating node count goes down even more (as discussed above). Furthermore, propagating larger blocks through the network results in more uncle (orphan) blocks being created. This in turn negatively impacts the block rewards that miners receive as the other miners of these uncles receive a block reward as well. Not only would the network start dropping in validator count, but the miners could begin to connect directly to each other to avoid high uncle rates. Inevitably, this will marginalize the smaller miners, further centralizing the network because they are unable to handle the income volatility.

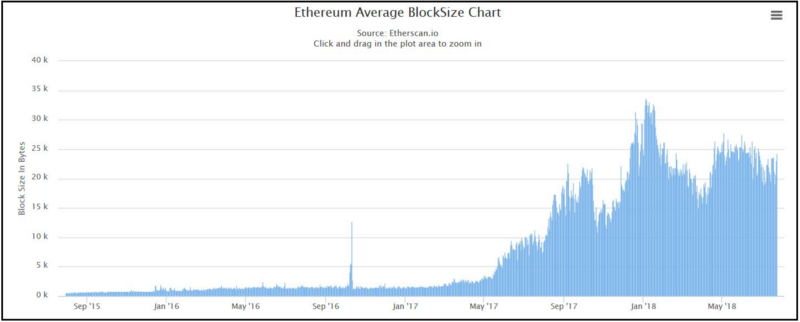

The following charts shows how the average block size and block gas limits has increased over time:

The Oracle Problem

One of the most interesting characteristics of Bitcoin is that its underlying cryptocurrency or token is native to and an essential part of the system. Without the token, the entire solution collapses. With Ethereum however, the assets being traded between parties are external to the network, and not native to the system.

Jimmy Song wrote an interesting article about smart contracts that uses property as an example. If for example, peers are exchanging a property for cryptocurrency, the property is not native to the system. All records of the property are recorded outside of the Ethereum platform. The only thing that Ethereum, or the DApp enabling this exchange can provide is some form of digital representation (token) of the property. It is not the property itself though.

Providing the parameters or inputs for the execution of the contract therefore requires an external ‘oracle’ that can gather information about the real world outside of the network for input into the contract. This means you now require some degree of trust on an external validation mechanism, and this undermines the entire trustless intent of the network. Until such time as the entire value chain and all the assets (property ownership, identity, etc.) are all on the Ethereum platform, and the ownership of these assets is recorded solely on these networks, such that digital ownership means actual ownership in the real world, one will always have to exit to the external world for the verification of the conditions that drive the contract execution. So therefore, one may as well perform whatever contractual execution is needed external to this network in the first place. Especially as it will be more cost-effective, as discussed below.

In the case of a physical asset such as a property, the ownership of the property needs to be tightly linked to, or be the same as the ownership as reflected in the deeds registry! Buyers of the property need to trust that the digital representation or the token actually represents the property, and that when he/she takes ownership of the token, the property legally belongs to him/her. Without this, the digital world of Ethereum will always need to know, via an oracle, what the legal status in the physical world is.

But assuming you can get past this challenge, additional challenges then subsequently emerge. For example, what happens when a token is stolen? Does the property now belong to the new token-holder? Or more strangely, what happens if the token is lost? Who would the property then belong to? These problems can be solved, but it would require the intervention of lawyers who use contract law that governs ownership in the physical world. These decentralized, Ethereum based-businesses will always have to leave their digital world for some reason, which should leave the investor questioning why the solution was not built outside of Ethereum in the first place, especially if the smart contract does not need to be decentralized.

Ethereum enables unsound business models and cryptocurrencies

Ethereum’s primary value proposition is its ability to execute smart contracts on a decentralized basis, and to enable the creation and maintenance of DApps. As discussed above, the real-world demand and business case for decentralized smart contracts and DApps remains extremely questionable. To date, it appears that the developers are more excited about DApps than what the general consumer is.

The reality is that smart contracts do not need to be decentralized. Running it on a decentralized basis is so resource-intensive, that the cost benefit associated to decentralized business models remain questionable. More importantly, centralized or intermediated business models have many advantages!Middlemen or intermediaries such as Airbnb, Uber, Visa and Amazon can do arbitration between buyers and sellers, manage customer complaints, provide fraud protection benefits, include additional value-add services by partnering with other 3rd parties, provide bulk discounts to buyers, provide customer service enhancements based on user-feedback, offload non-performing service providers, interface with insurers for cover or claims management, provide tax-related services/documents where relevant, etc. What kind of technological complexity would be required to build a digital ecosystem that operates autonomously with these kinds of benefits? How will decentralized businesses running DApps be able to compete with these real-world business models? The sustainability of these DApps therefore remains extremely questionable.

So, by attempting to achieve disintermediation through machine-only execution, what you actually get is unnecessary complexity of having to encode all possible scenarios with the subjectivity and nuances that can only be navigated after many years of legal training. Furthermore, you have drastically increased complexity in order to achieve a trustless network for the exchange of value, while still having to trust someone or something external to the system. To add to this, these complex contracts (that will probably be bug-ridden because of the complexity) are processed on a decentralized basis by thousands of nodes? How can all this complexity be worth it?

Ethereum’s role in creating potential security tokens

The business models built on top of Ethereum effectively go through something similar to an IPO in order to raise funds. Given the nature of the fund-raising process, Ethereum and all the businesses enabled by it will very likely be labelled as securities and become regulated as such. To further support this view, consider that these ICO start-ups have CEO’s, marketing departments and all the same power structures as traditional companies.

If this materializes, all players in the cryptocurrency value chain will have to comply with securities regulations. Creating the compliance functions in these startups/businesses will add cost and operational overhead. Cryptocurrency exchanges will be subject to exchange-related regulation. ICO advisors could become subject to advice-related regulation. Custodians and asset managers managing crypto portfolios will be similarly impacted. The regulation will impact everyone. For this additional burden and overhead, all the players in the value chain will demand even more value from these tokens.

Where to from here

The cryptocurrency investor is urgently advised to critically review his/her token holdings. The downside risks to Ethereum-based tokens, especially where the underlying business case is weak, appears to be higher than the upside benefit, at least in the long run. In the short term there will very likely be opportunities for speculative trades, which is dangerous as well. Attempting to trade cryptocurrencies when you are up against algorithmic trading systems will generally prove to be painful.

Regulators need to review the advice they are receiving from industry players in the formulation of their policies and regulations for cryptocurrencies. This could be the one time where regulators take the lead in terms of policy development and consumer protection, rather than waiting for some kind of fallout before they respond. This is a complicated space, and now more than ever consumers need protection. The ordinary consumer will not have the necessary access to sound advice (and sound advice in this space is difficult to ascertain), but the regulator certainly does.