Cryptocurrencies and blockchains are incredibly intriguing, but mostly misunderstood

I’m writing this article for an ex-colleague of mine, who is “sold on the potential of blockchain” but “always struggled understanding real use cases for crypto-currencies”. He is an exceptionally smart and qualified actuary, the Head of Digital at a large financial institution in South Africa, and had many successes during his previous career at Accenture. Clearly, he has intellectual horsepower, and yet he “struggles” with this. He is not the only one.

I have worked with many technology professionals, heavy-hitter management consultants and highly regarded payment specialists with years of banking and regulatory experience, all of whom understand blockchains differently. This non-technical article will aim to clarify what is revolutionary and what is not, what adds value and what does not and also what makes this space interesting. It will take the following approach:

- For those who need the bottom line without the detail, an executive summary of the entire article is provided upfront.

- The detail (which will not be technical) will begin with Bitcoin, the first blockchain and cryptocurrency. It will clarify what problem it was meant to solve and explain the fundamentals of blockchains and cryptocurrencies.

- We will then use this understanding to analyze other cryptocurrencies and what makes them useful or not.

- And lastly, enterprise blockchains and its application will be covered.

Bitcoin, as at the time of writing shows the most promise of becoming a universal, mainstream form of money in the near future. Bitcoin, not the ‘blockchain’, was the game-changer. Comparing Bitcoin to its derivatives and other non-Ethereum-based currencies such as Monero or Cardano is too complex to be included here. However, this article will include Ethereum-based tokens as they constitute a sizeable portion of the exchange-traded cryptocurrencies available today.

Bitcoin, not the ‘blockchain’, was the game changer.

Ethereum-based tokens or cryptocurrencies, of which there are at least 600 being traded on cryptocurrency exchanges are not intended to be used as a universal medium of exchange. These tokens are limited to and used solely for participating in particular business ecosystems that are managed by ‘decentralized’ applications (DApps). These businesses are not creating anything new or revolutionary. Rather, they are wedging cryptocurrencies and blockchain technology into traditional business models, making the operations cumbersome, complex and impractical in the process.

These ecosystems run on a risky and expensive platform, Ethereum, and have largely been created on the basis of weak business cases. So in addition to having limited utility, these tokens and their businesses are unlikely to survive in the long run.

Ethereum-based…businesses are not creating anything new or revolutionary. Rather, they are wedging cryptocurrencies and blockchain technology into traditional business models…

Enterprise blockchains are not disruptive nor revolutionary. The business cases for enterprise blockchains are weak. The term ‘blockchain’ has been hackneyed and used too liberally. Using the term ‘blockchain’ rather than ‘distributed ledger’ in a B2B setting only perpetuates unfounded hype. Enterprise blockchains are actually distributed ledgers, and practically speaking do not offer any meaningful advantages over today’s database and enterprise technologies. It is simply a different technology that is attempting to solve business interoperability issues between entities. Technology will not solve these business/political problems.

The use cases touted for enterprise blockchains have clearly emerged from an insular technical paradigm, a paradigm that appears to be oblivious to the cooperative processes already entrenched between competitive participants. It ignores the extensive legal, compliance and contractual mechanisms already in place to enforce honest cooperation, the regulatory oversight to protect consumers and the lack of the political will for participants to focus on interoperability projects rather than their own profit motives. Using blockchains to resolve interoperability issues reflects the mindset of a techie or consultant, not the mindset of CEOs or managing directors that will have to approve and sign off on the spend for a blockchain project that gives them what they already have.

Enterprise blockchains … practically speaking do not offer any meaningful advantages over today’s database and enterprise technologies.

What is so special about Bitcoin?

Bitcoin (I’ll use upper case “B” for the Bitcoin network in its entirety, and lower case “b” for the bitcoin currency) introduced a system of payments and money with unique properties the world has not seen before. It is a system that:

- Is decentralized in its decision-making process, meaning that no one owns or controls its operation. No government. No central bank. No credit card payment network. No one;

- Has a form of digital money that is limited in supply, inflation-resistant and cannot be copied. Everything digital we previously knew (a song, picture, or an email) can be copied. Bitcoins cannot be copied. When you send someone an email, you still keep a copy. Not with bitcoins. When you send someone bitcoins, you no longer have a ‘copy’ of it. Having a digital ‘thing’ that cannot be copied and is simultaneously rare is quite revolutionary;

- Ensures that bitcoins cannot be forged/counterfeited for double-spending. You cannot keep a copy of the bitcoins you spent at one merchant and use that for payment at another merchant;

- Provides trust that payments can be made, without having to know or trust anyone else on the system, or without needing an overarching authority;

- After more than nine years of operation, has grown into the largest, most secure network the world has ever seen and has proved to be invulnerable to cyber-attacks;

- It has no ‘off’ switch anywhere. To bring it down requires the bulk of the Internet to be brought down; and

- Has no legal owner that can be sued, or overarching authority that can forcefully be shutdown. This is not the case for other cryptocurrencies.

Bitcoin vs. the banks

The introduction of Bitcoin in 2009 ushered in a new era for us. We have never had such a system of trust without an overarching authority. It is not a version of payments that we already are familiar with (PayPal, Zapper, etc.), or a payment system that is built on top of existing payment infrastructures. Prior to Bitcoin, trusted third parties or intermediaries (banks, central banks or card companies) were needed to track and reconcile payments to ensure the legitimacy of money transfers. This system of money works well, but…

With this traditional system, these authorities have the ability to block or limit your transactions. They have the ability to refuse you a bank account. They have the authority to charge fees for it. They have the ability to demand that you first identify yourself and make a deposit before activating your bank account, etc.

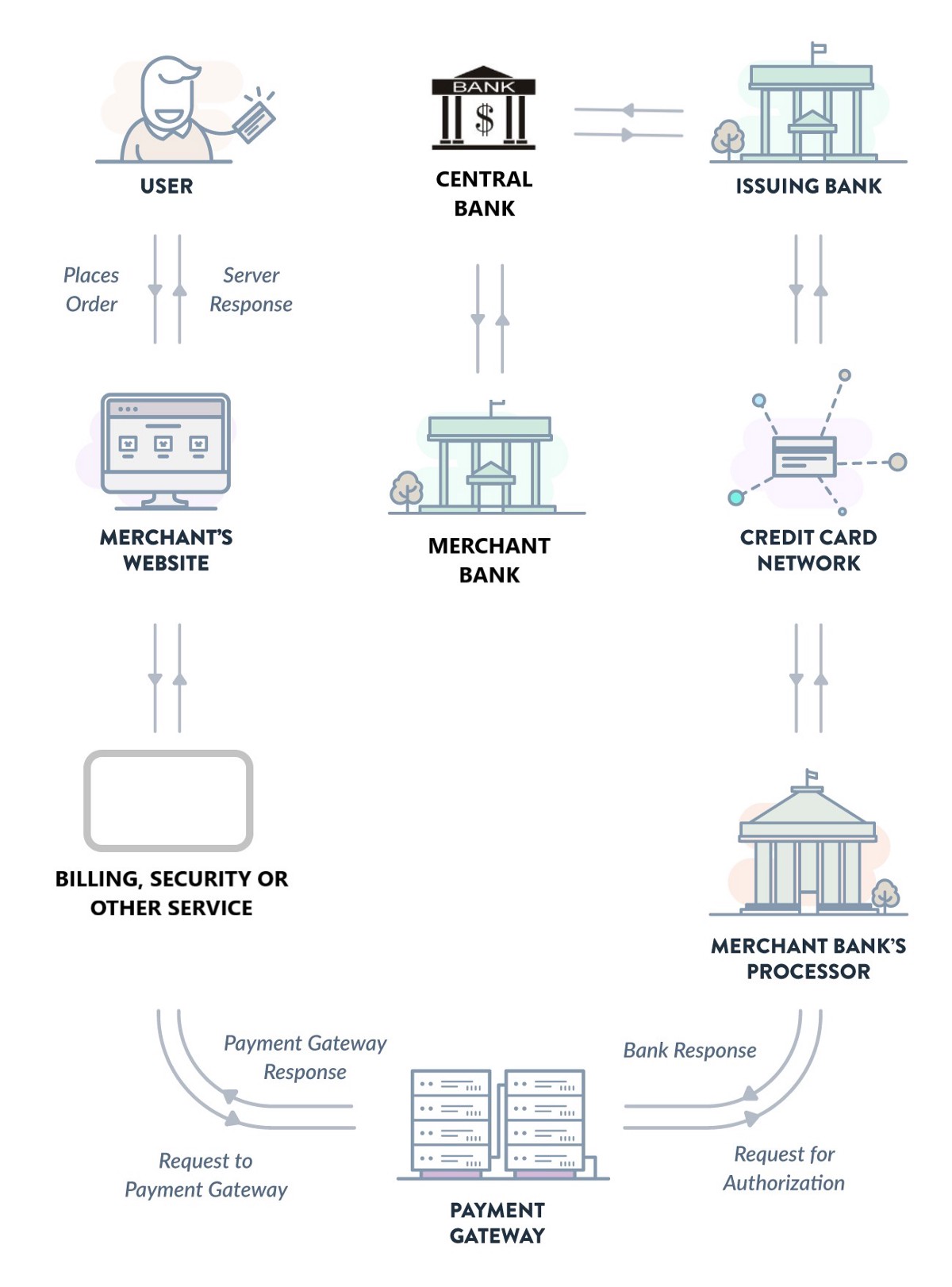

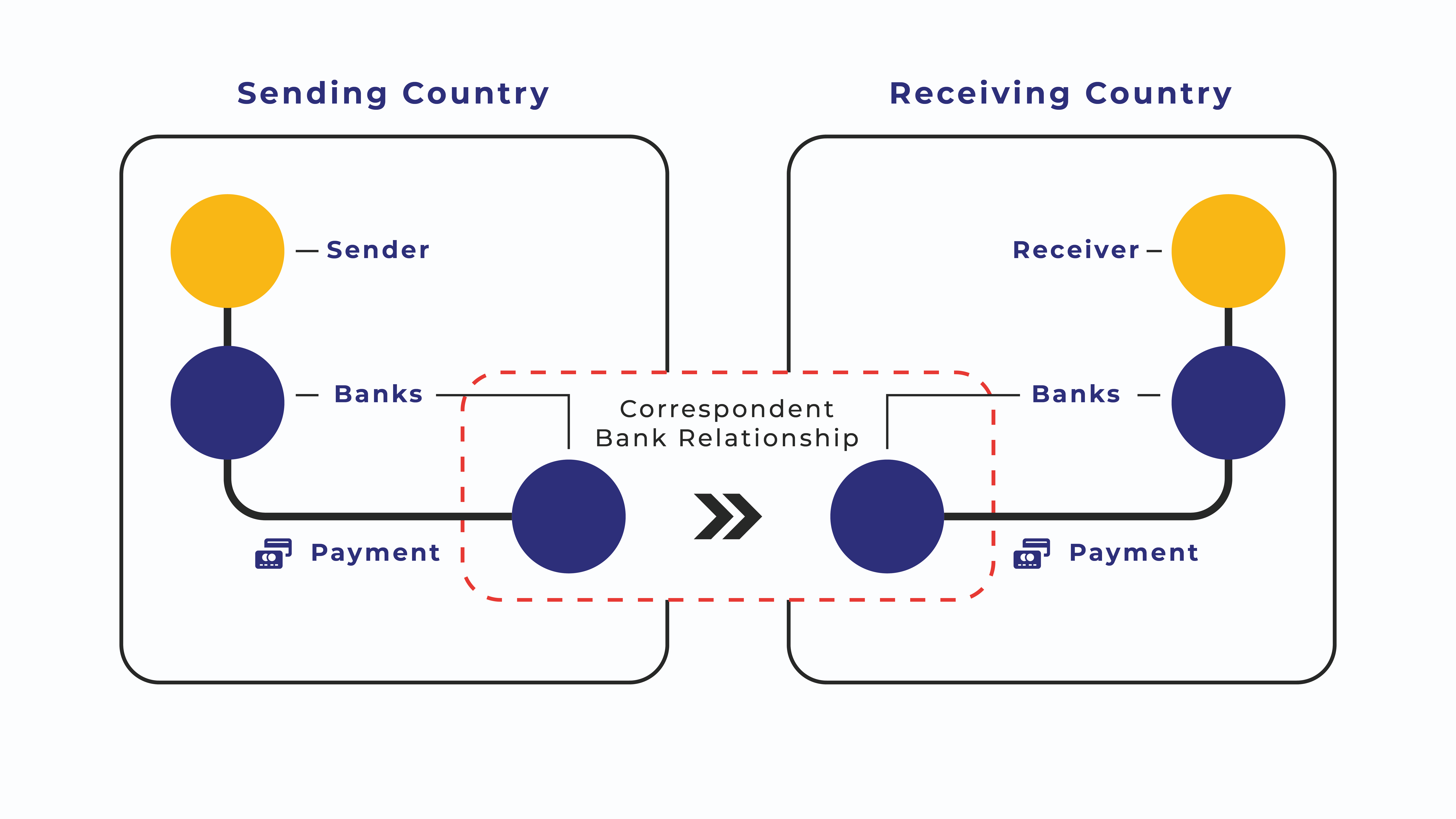

But the consumer perspective is that they can exchange cash without identification and without transaction fees. With cash, money exchanges hands between people, peer-to-peer. With electronic payments, money goes through a number of institutions (each taking a fee) before reaching the recipient. Not with Bitcoin. Bitcoin is peer-to-peer. A digital form of cash so to speak. No intermediary or bank required.

For virtually everyone reading this document, our banking system works well (ignoring financial market crashes and hyperinflation) and Bitcoin is unnecessary. But there are roughly 2 billion unbanked adults in the world today. Is it possible that our notion of Bitcoin being rubbish stems from our paradigm of privilege?

Just as the introduction of the internet allowed the previously-restricted free flow of content, which we today see as normal, today’s younger generation and future generations will see payment freedom as normal. The idea of not being able to send money to anyone in the world, or having to go through the hassle of converting currencies or having to open a bank account (which can take up to an hour, and a few days for your personalized card to be delivered) will seem bizarre.

Bitcoin as a form of money…Wait. What is money?

…authorities have the ability to block or limit your transactions.

… the ability to refuse you a bank account…

… the authority to charge fees for it.

… the ability to demand that you first identify yourself …

Money is anything that people are willing to use in order to systematically represent the value of things to enable the exchange of goods and services.

Bitcoin does challenge our most fundamental notions of money. Money, which is so pervasive, entrenched and fundamental to society is not something most people understand or are educated in. In general, we don’t know what gives value to money or know the difference between fiat money and representative money. Why do some believe Bitcoin will be a superior form of money? Why do some Nobel prize winners, economists and central bankers dismiss Bitcoin as fake and useless as a form of money?

What makes something money? What gives money value? Is it the number printed on the currency note? Is it the belief that central banks hold the equivalent value of gold that backs the currency (which has not been true since the 1930s)? Is it the belief that your government guarantees the value of the notes? What happens to this belief when for example Venezuela’s inflation reached an all-time high of 82766 per cent in July of 2018? Or when hyperinflation in Zimbabwe reached an estimated at 79,600,000,000% per month in mid-November 2008? Or when the Indian Prime Minister declared the 500 and 1000 rupee notes as worthless towards the end of 2016?

Money is anything that people are willing to use in order to systematically represent the value of things to enable the exchange of goods and services. Historically, money took all kinds of forms such as Cowry shells that were used to conduct trade around Africa and Asia. Money also took the form of coins, starting with the Lydians of ancient Greece around 600BC. But coins needed to be forged, were heavy and took up space, which lead to the emergence of paper money.

What gives money value is the belief society has that it has value and that it will be accepted for economic exchange. It is the belief that if you purchase a good with this thing called money, that your money will be accepted and your good will be provided. Our society has agreed to and collectively believe our banknotes have value. For something to be regarded as a reliable form of money, it needs to have particular properties. For example, it needs to be durable and resilient. Leaves would be a terrible form of money. It also needs to be scarce. Seashells cannot be used as a form of money for societies on the coast.

Back to bitcoin as a form of money

Today, bitcoin prices fluctuate way too much for it to be used as a form of money. Instead, it is used as a speculative investment and trading vehicle for people to create wealth in the traditional fiat money paradigm. The mentality is still one of creating more Rands or Dollars because that is the currency used to buy things, not bitcoins. So why do some believe that bitcoins will be superior to fiat money in future? These are some of the interesting arguments:

- Bitcoins are provably scarce — there will only ever be 21 million bitcoins. We know exactly how many coins will be mined by when. No central government or bank can predict the money supply of fiat currency. Fiat money has no hard limit on its supply. Poor monetary practices can, therefore, lead to inflation and other financial crises.

- Bitcoins are resilient and cannot easily be confiscated by governments. In a world of fiat money, governments can seize your assets.

- Bitcoins are durable in that they are backed up on thousands of computers globally.

- Bitcoins are fungible.

- Bitcoins cannot be counterfeited.

- Bitcoins are portable, borderless, immediately transferable anywhere, has no currency conversion complications, and does not require a 3rd party or permission from any authority.

- Bitcoin transactions are programmable. It can be programmed to enable different kinds of economic activity. This is not possible with fiat currency.

In the crypto world, Bitcoin is currently viewed as the leading cryptocurrency that will eventually become a mainstream form of money. The view is that the current dominance of fiat money is based solely on the momentum of tradition and will wane with time.

But many others believe that Bitcoin is a lousy form of money??

… there will only ever be 21 million bitcoins …

Fiat money has no hard limit on its supply …

… cannot easily be confiscated by governments…In a world of fiat money, governments can seize your assets.

It is true that if something is to be considered a form of money, that its perceived value needs to be stable and reliable. Society needs to have certainty about its value from hour to hour, day to day, or even year to year. Without this, you cannot price products in this form of money. Nor can you negotiate contracts or borrow and lend against it.

Another concern is that Bitcoin can be forked to create other cryptocurrencies, potentially creating an unlimited supply of cryptocurrencies that will eventually reduce their value to zero. On the surface, these are good arguments, and would certainly appeal to most people’s intuition. But…

Volatility is not an inherent attribute of or intrinsic to Bitcoin! Volatility is the function of a market that is trying to decide on its value. Bitcoin is new, but its volatility has already been reducing over the years. It should become more stable as adoption increases, as liquidity improves, as its velocity increases and so forth. The market will eventually determine its value, and that value will be the new reality, independent of fiat currencies.

Once you understand the fundamentals of Bitcoin and other cryptocurrencies, you will realize that forking is not an issue. One can fork Bitcoin and create a new currency, but this new currency is not bitcoin. Bitcoin is an entire network, made of the infrastructure, the miners, the wallets and all the other institutions building solutions on it. You cannot copy this network. You cannot copy the long track-record and credibility it has achieved. And you cannot copy its brand.

Bitcoin scarcity remains intact. Regardless of how often you fork a new blockchain from it.

if something is to be considered a form of money … its perceived value needs to be stable and reliable …

Society needs to have certainty about its value from hour to hour, day to day, or even year to year…

How did the blockchain come about and what problem did it solve?

To understand blockchains, it is useful to first look at everyday challenges that many of us can identify with, that Bitcoin was meant to overcome.

Bitcoin was designed to solve the following fundamental monetary and payment challenges:

- Electronic commerce and transactions across the globe relies on many different codependent institutions. These include central banks, banks, credit card networks, payment processors, etc., all of whom introduce costs for the role they play in the payments value chain (illustration below). This in turn increases the costs of transactions;

- Successful electronic commerce requires that all institutions involved in processing payments are trusted by society. This is why the regulation of large institutions is required, to engender this trust. Examples of these regulations include KYC, AML and PCI DSS (Payment Card Industry Data Security Standards);

- Cash can be counterfeited, which leads to something called double-spending;

- Governments have monetary sovereignty, and along with financial institutions have the ability to freeze your bank accounts, seize your assets, limit your ability to transact, control the amount of foreign exchange that is conducted per individual per year, and so forth. This can seem unfair in that individuals do not have control over their money and have all of their transaction records open to authorities, but in return financial institutions’ and governments’ transactional affairs are not similarly transparent to the general public. Bitcoin, therefore, aimed to remove the ability of any authority or entity in the value chain to censor, stop, reverse, alter, or otherwise control payments; and

- Central banks and governments are able to control money supply in their efforts to manage the economy. However, inappropriate practices took by central authorities that led to incidents such as the 2008 financial crisis, or the hyperinflation in Zimbabwe, further fueled the need for a currency that could not be created out of ‘thin air’.

To summarize…

Bitcoin aimed to create a peer-to-peer network for payments that:

- Did not require trust in any one authority, i.e. was ‘trustless’;

- Was not under the control of any authority, i.e. was censorship-resistant;

- Were immutable, (tamper-proof) and irreversible;

- Prevented double-spending;

- Was decentralized in that decision-making about payments was given to the entire network of payment participants and not to one or a few elites. The records of these payments would be replicated across the network, so that in order to steal money or tamper with transactions, one would have to attack the entire network, not just one central unit such as bank; and

- Legitimately created money with limited supply.

Bitcoin’s answer to the above challenges:

Distributing the ledger. One aspect of Bitcoin’s solution to the decentralized and trustless processing of payments was to have all the participants (nodes) in this payment network agreeing on the validity of transaction records, rather than one central authority validating and owning the records. All nodes, therefore, have to keep the same record or ledger or database of transactions. Hence the term Distributed Ledger Technology (DLT).

Introducing cryptography

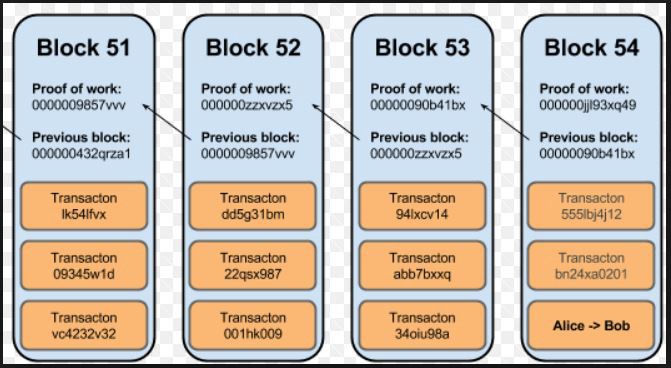

The starting point for making the records in this distributed database immutable is to cryptographically link or chain groups or blocks of transactions together. Hence the term blockchain. Each block of transactions contains a cryptographic hash of the previous block of transactions. More accurately, it contains a hash of the previous block’s header. Therefore, if a transaction in any of the blocks of a particular node is falsified, the hashes of all its subsequent blocks are altered and these altered blocks will not mirror the blocks maintained by the other nodes. Unfortunately, this cryptographic chaining of blocks appears to be what so many people think gives the blockchain its immutability. This is very far from the truth.

… this cryptographic chaining of blocks appears to be what so many people think gives the blockchain its immutability. This is very far from the truth …

Introducing consensus.

Without a central authority, the network needs a consensus mechanism, an agreement or a protocol of sorts where all nodes agree on how to process payments and add them to the blockchain. All nodes see blocks broadcast across the network, and somehow everyone needs to believe and trust that if everyone else is following this protocol, that they will end up recording and adding the same legitimate transactions to the blockchain.

Proof of Work.

Bitcoin’s consensus mechanism is called Proof of Work. This protocol basically says that all nodes have to agree that whichever block or chain of blocks required the most work or computational power to be created in a specified, arduous manner, will be what is added to the main chain. And for this, the nodes that created those blocks will receive a block reward in the form of bitcoins. The reason for using computational work as the deciding factor is because you can game the system in such a way that it becomes computationally infeasible for any one node to add fraudulent transactions to the blockchain. Here’s how…

Creating the blocks.

This is severely simplistic, but this consensus mechanism sets the nodes up to compete with one another to create the next block on the chain (and to earn bitcoins in the process). Mining nodes have to take transactions that have been made in a 10 minute period (on average), group them together in a block, and simultaneously find a unique number that when added to the block data, gives the block specific cryptographic properties.

Finding this number (which is proof that computational work was done to create the block) is very difficult. It requires nodes to loop through billions of trillions of numbers per second to find the right one. This is why the process is called ‘mining’. Nodes are basically mining for a particular number by working through trillions of possible numbers, the same way that a gold mining plant mines through and process massive amounts of ground and rock to find that valuable piece of gold.

Once all nodes validate that this number is valid for the new block (verifying the number is trivial compared to determining it), the block is added to the chain. Miners with superior computing have a higher probability of mining the winning blocks.

Making the blockchain immutable.

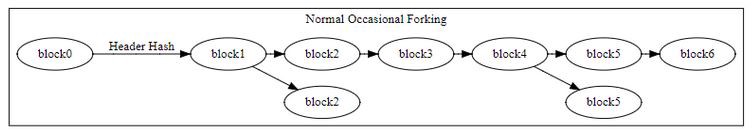

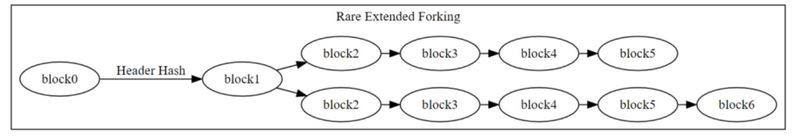

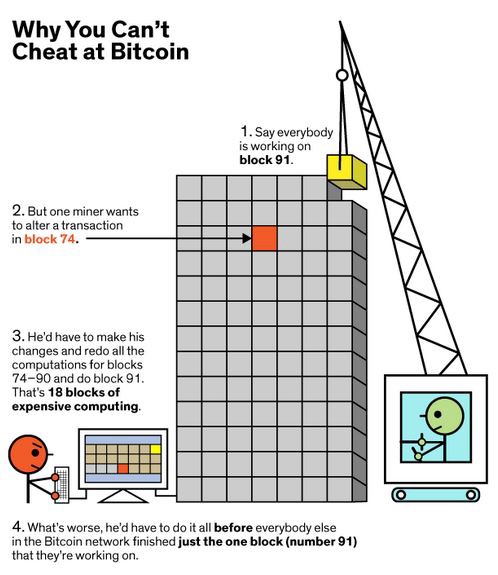

If a node attempts to create fraudulent transactions, it would have to have superior computing power to have a high probability of creating the winning block that contains its fraudulent transactions. Even if this fraudulent mining node manages to create the winning block (e.g. block 2 or 5 below), all other nodes will detect the conflict with other winning blocks being created during those ten minutes. At this time, the blockchain ‘forks’ and two possible chains exist.

In this case, nodes will continue to monitor all the subsequent blocks being mined, building two chains in the process. Because creating a winning block is more likely with massive computational power, the fraudulent node will have to have an inordinate amount of computational power to continuously create more winning blocks to extend the chain on top of its fraudulent block.

The probabilities are such that unless this fraudulent node has more than 50% of the computing power of the entire network, it becomes virtually impossible to continuously beat other miners and extend its chain by even 3, 4 or 5 blocks. This forked, dishonest chain will then be discarded as the network only adds blocks that required the most cumulative computational power to be created. The diagram below is a simplistic but very intuitive analogy to convey this concept.

This is how we arrive at decentralized consensus for how transactions are recorded in the distributed ledger. As more nodes participate, the more decentralized the network becomes. The more decentralized the network becomes, the more secure and immutable it becomes. As more nodes participate, the more difficult it becomes for anyone to introduce fraud. This is the real innovation. The extent of the decentralization is what gives the network its immutability. Not the blockchain itself. The blockchain, along with the Proof of Work consensus protocol, the bitcoin incentive mechanism and a high degree of decentralization is what creates the magic. All these components work together to create a system where no one can cheat the system and where trust is achieved without needing to trust or know anyone, or to put someone in control.

The extent of the decentralization is what gives the network its immutability. Not the blockchain itself.

Along comes Ethereum…

The arrival of the Ethereum platform in July 2015 marked another major milestone in the history of cryptocurrencies. Ethereum attempted to improve on Bitcoin by extending the trustless exchange of money to the trustless exchange of other forms of value. It enabled faster transaction processing times. It extended the smart contract functionality available in Bitcoin Script. It also attempted to become the general-purpose blockchain upon which other blockchain-type solutions could be built. It’s underlying currency or token is Ether.

Ethereum is different to Bitcoin because…

Unlike Bitcoin where there were no tokens to start with, the Ethereum Foundation created Ether upfront and sold just over 60 million Ether for 31,591 bitcoins (about $18m USD) during its 42-day initial public sale in 2014. This was to pay back debt and to finance the ongoing development of Ethereum. Even though these funds are managed by an NPO (Ethereum Foundation), the process still mimics the share/stock/security issuance process of an IPO. The risk of Ethereum one day being falling prey to some kind of regulatory intervention and Ether being regulated as a security cannot be ignored, it if survives that long. This will create compliance issues for any institution involved in Ether.

… attempted to become the general-purpose blockchain upon which other blockchain-type solutions could be built.

Ethereum has challenges on multiple fronts.

Attempting to enable the decentralized and trustless execution of other forms of value such as disk storage or workspace is indulgently impractical in today’s world of business. This is because:

- Ethereum and its DApps (more on this later) are replicating existing business models that do not need to be run on an expensive and experimental technology platform like Ethereum.

- Having to extend the functionality of the underlying smart contracts that enable this decentralized exchange of value invites a host of problems. The smart contracts are more vulnerable to cyber-attacks and Ethereum has been attacked on a number of occasions. Examples include the DAO ‘Hack’ and denial of service attacks in 2016.

- Furthermore, Ethereum’s more extensive smart contracts and account-based transaction processing (vs. Bitcoin’s simpler UTXO transaction model) creates enormous scalability issues. The total disc space to run a full archiving Ethereum node is more than 1TB after 3 years of operation, compared to the Bitcoin blockchain that is about 175 GB after more than 9 years of operation. As a result, the number of Ethereum nodes has been reducing during the last 8 months or so, impacting its degree of decentralization.

The next craze: Ethereum-based cryptocurrencies/tokens

The total disc space to run a full archiving Ethereum node is more than 1TB after 3 years of operation, compared to the Bitcoin blockchain that is about 175 GB after more than 9 years of operation.

… these DApps are running on an expensive blockchain platform, the costs of which are increasing as it’s blockchain state grows.

Ethereum is a platform on which other ‘decentralized’ applications (DApps) can operate. Golem, for example, is a DApp built on Ethereum that enable users to share unused computational resources with each other. It uses the Golem token (GNT) to enable transactions between users. 1,000,000,000 tokens were created, of which 820,000,000 were initially sold to raise about $8.6m USD. Again this token was created, not mined.

Another example is Primalbase, a DApp running on Ethereum for users to share workspace. It uses the Primalbase token (PBT) to facilitate transactions. There are at least 600 or more Ethereum-based tokens that are traded on cryptocurrency exchanges at the time of writing this article.

People only need these tokens to participate in and use the services in the DApp and/or to receive payouts from profits (like dividends). And these DApps are running on an expensive blockchain platform, the costs of which are increasing as it’s blockchain state grows.

Furthermore, these DApps will very likely not be able to compete with today’s competitive business models, given the flimsy business cases on which they are predicated. The tokens are tied to the success of these DApps and will very likely lose their value over time.

Hype statements about blockchains bandied about since 2016 include:

- “The use of blockchain within corporations (enterprise blockchain) will dominate real-world projects in the near-term”;

- “Blockchain has the potential to revolutionize nearly every industry”; and

- “Learn how hundreds of companies are transforming business on dozens of networks powered by the [a global tech giant] Blockchain Platform”

Where is the revolution? What has been game-changing?

There is so much activity in the blockchain space. IBM is working with hundreds of enterprises on blockchain implementations. It appears that there have been tens of thousands of blockchain pilots run within corporations. So clearly the interest in blockchain is undeniable.

Why do we need enterprise blockchains?

Enterprise blockchains came about as there was/is a perceived need for entities to exchange value or information in a trustless manner, similar to what Bitcoin and other open blockchains did. However, the requirements for enterprise blockchains are different in a B2B setting. Enterprises are concerned about the privacy and security of their data and IP. Enterprises also require faster transaction throughput compared to open blockchains.

As a result, enterprise blockchains operate differently in the following ways.

- They employ ‘permissioning’ whereby only ‘trusted’ participants run nodes, and users are given permission to participate in the system;

- Transactions can be made private; and

- They employ different consensus mechanisms to enable faster transaction throughput.

Their consensus protocols change the trade-off between speed, energy and security. The most secure protocols such as Proof of Work by design are energy-intensive and slow. In a private or permissioned chain, the network selects the groups that will run the nodes. Since these groups are selected from a pool of trusted entities, they create ‘trusted’ nodes. Trust is therefore much less of a concern than in a public blockchain. Enterprise blockchains can, therefore, afford to use less secure consensus protocols to maximize the speed of transactions while reducing energy consumed.

Well, that’s the logic being touted out there.

Are we missing the point?

An interesting quote from a passionate blockchain enthusiast that is very representative of the general mindset, reads as follows: “users are able to create database environments where multiple mutually untrusting users can exchange value … without a central coordinator. By combining concepts from cryptography …, blockchains remove the need for trust in a system, ensuring that users … interact with reduced reliance on third party authorities”.

However, there already are ‘trusted’ participants in these enterprises or value chains. Attempting to create ‘trustless’ transactions makes no sense. Immutability is not achieved either. What makes an open blockchain such as Bitcoin immutable is not the fact that it uses a blockchain or cryptography. Immutability is achieved when the blockchain, the Proof of Work protocol and incentives work together in a sufficiently decentralized context. The Bitcoin consensus mechanism overrides any one individual’s personal ambition. The system is designed to avoid one person taking control. So why would you want to replicate these concepts in an enterprise or B2B context? Bitcoin is designed to be inefficient. It is a deliberate feature. Attempting to create faster but less secure consensus mechanisms completely misses the point.

… there already are ‘trusted’ participants in these enterprises or value chains. Attempting to create ‘trustless’ transactions makes no sense.

Enterprise blockchain use cases are naively technology-driven

It is clear that the adaptation of ‘blockchains’ to the enterprise context focuses more on the technology, the security, the transaction-throughput and so-forth. Too little consideration for practical reality is given. Let’s use a poignant, real-life example that highlights the issues around interoperability between competitors, viz. banking.

Banking is an excellent example of where competitors have to cooperate. They need to facilitate transactions between their customers, and they have a fantastic example of a trusted authority, viz. the central bank. Enterprise blockchains would offer excellent value in such a setting right?

Well consider this. Banks already have contractual obligations and payment reconciliation mechanisms between them to ensure that the correct transaction amounts are cleared and settled between them. They already have the central bank that further ensures that the correct amounts are settled between them. In the case of card payments, the likes of Visa and Mastercard also keep records of transactions (that need to match the bank’s records) in order to appropriately charge banks for their services. Furthermore, various interbank payment bodies and forums are in place to ensure continued interoperability. Do you honestly believe that banks do not have the ability for example to share debit order information, beneficiary payment information, or even KYC information so as to enable customers to seamlessly switch between banks? Of course they do. But they do not. It is not a priority for them. Why should they lower the hurdles to make it easier for their clients to leave them for another bank?

Banks offers an excellent illustration of where it makes no business sense to spend money on an interoperability project that could potentially hurt its own bottom line. Banking CEO’s do not have the time or inclination to approve and sign off the spend for projects that will give them what they already have.

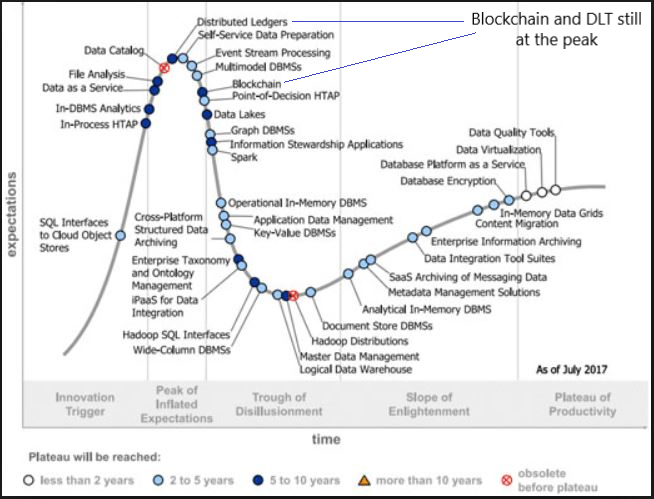

It comes as no surprise that a 2017 Deloitte study shows less than 8% of enterprise blockchain projects are no longer being actively pursued, or that Gartner concurs that there is more hype than substance (below).

Enterprise ‘blockchains’ do not enable anything new.

In any context where decision-making about transaction records is not decentralized, where trust in one or more entities is required to validate transactions, or where transactions can be censored or approved by senior authorities, the use of the term ‘blockchain’ becomes problematic and causes confusion and fierce debates. Furthermore, when the average layman hears the word blockchain, Bitcoin or cryptocurrency comes to mind. It would therefore be circumspect to use the term ‘DLT’ rather than ‘blockchain’ in an enterprise context.

Most importantly, distributed ledger solutions do not solve for anything that today’s technology can’t already handle. DLTs become a complicated and needless waste of resources in its attempt to solve an interoperability problem, which is a business/political problem, not a technology problem. A normal database would very likely be a much more efficient solution in just about any B2B context, assuming you can get competing parties to agree to work together in the first place.