Bitcoin is important because…

Bitcoin is humanity’s first successful attempt at creating a form of money that cannot be easily controlled or seized by any government. It is a form of money that no legal framework to date is able to contain and constrain without violating fundamental human rights. It is a form of money that gives individuals, not governments, monetary sovereignty.

But more importantly, it is a revolutionary technology. It is the first form of programmable money. It is digital money that can be programmed to execute instructions and control payments based conditions that any payer can set. Unlike traditional fiat money, bitcoin payments can be controlled without any middleman needing to control, monitor, reconcile or execute the payments. It is a peer-to-peer, and individual-to-individual payment system.

Bitcoin is truly decentralized and censorship-resistant

Bitcoin was the first decentralised cryptocurrency, was not issued by a central bank and ten years later still thrives outside of the traditional banking system and regulatory frameworks. By decentralised, we mean that there is no central authority or central point of control. There is no legal entity or individual that owns the network. Unlike central banks, no one individual, elite group or corporation has any control over the money supply. This is very unusual or counterintuitive because, for many of us, money is associated with a bank, a bank account or a central bank.

Bitcoin is inflation-resistant

Bitcoins are the first scarce digital resource because they cannot be copied – its supply, like the supply of gold in the ground, is limited. Only 21 million bitcoins will ever be mined. Historically, if you sent any kind of digital asset across the Internet, whether it was an MP3 or a photo, you could still retain a copy once the asset reached its recipient. With Bitcoin things are different. Whenever you send this digital asset to someone, you do not retain the asset. Only your recipient holds it. And everyone on the network would know that you no longer have the asset, only your recipient does.

Many people think of Bitcoin as the first application for ‘blockchain’ just as email was the first application for the internet – this is both inaccurate and misleading.

The following videos provide simple yet powerful insights into the nature of Bitcoin and blockchains:

But surely we already have digital money? We don’t keep cash anymore. Instead we store it digitally in a bank. What makes Bitcoin special?

… bitcoin payments can be controlled without any middleman needing to control, monitor, reconcile or execute the payments …

… There is no legal entity or individual that owns the network …

Unlike central banks, no one individual, elite group or corporation has any control over the money supply …

Bitcoin is different to today’s digital money

Yes, the money we deal with is mostly digital these days. But even when you are transacting with this digital money through your bank’s online system, you are transacting through a digital veneer running on top of traditional banking systems that are still using traditional forms of money.

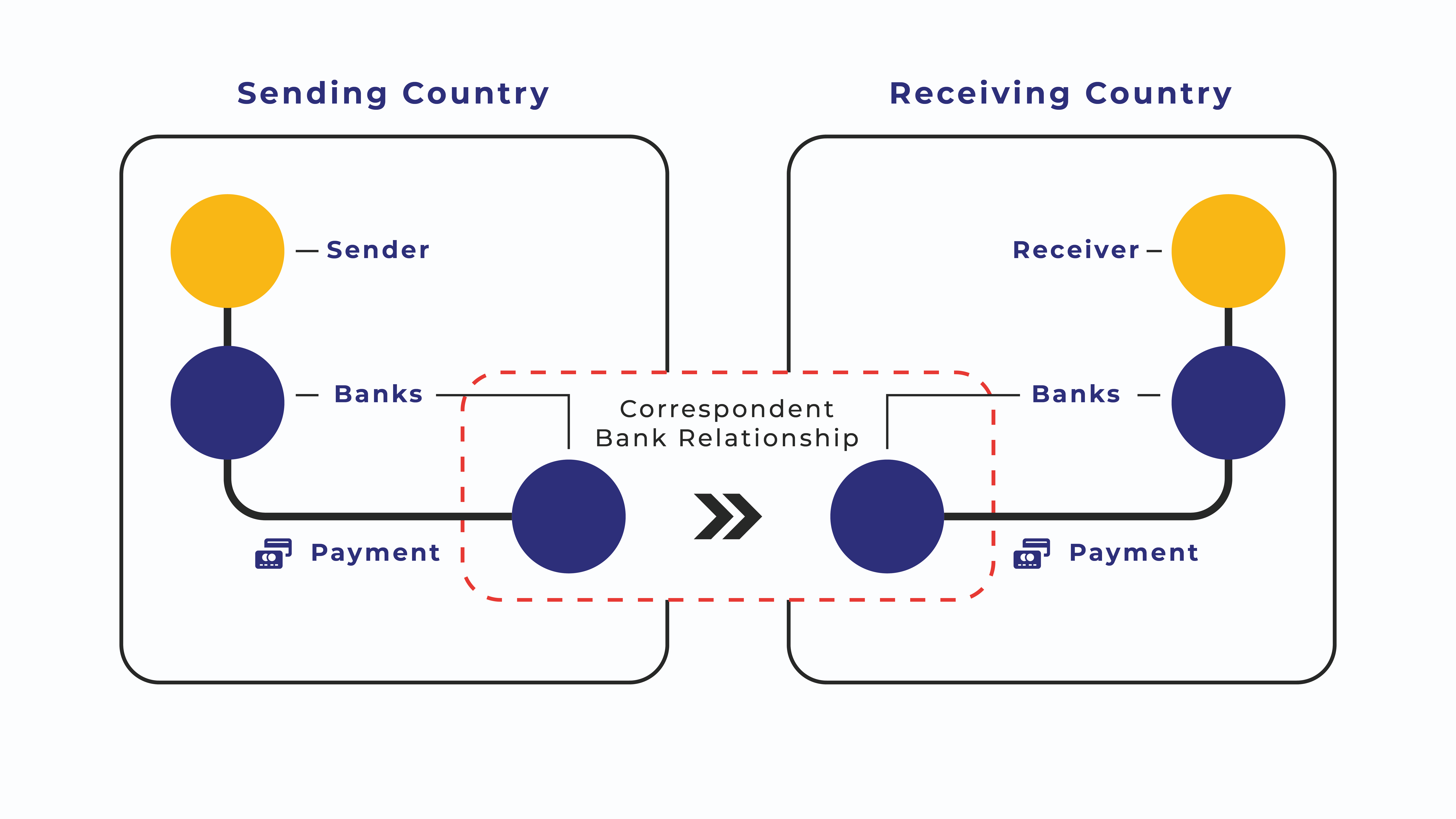

When making a payment using your app or Internet banking platform, both the payer and payee banks keep their own records of your one payment transaction. And usually, there are other intermediaries or middle-men who play a role in the completion of the payment process, each of whom keep records of transactions as well. For example, when you pay a merchant using your Mastercard credit card, the Mastercard network through which the payment is executed also monitors and keeps track of the transaction. Or when you are making an international payment, where your bank and the recipient’s bank are not the same, the payment transaction has to be processed through correspondent banks, where records will also be kept.

With Bitcoin, however, you can move your money from yourself to your recipient, without going through any 3rd parties. Furthermore, unlike traditional payments, reversals are not possible. Consider the example of when you use your credit card to rent a hotel room or a car, and funds are reserved. If the reserved funds are not required, it is released back to you and has the appearance of a transaction not having taken place. With Bitcoin, to get your money back, another transaction would have to be executed to send the bitcoin to you. This is a separate transaction and is different from releasing a reservation on your funds as would be the case with traditional money.

Bitcoin is different to other cryptocurrencies

Bitcoin is the first asset class that cannot be confiscated by an individual or entity with more power. No other asset has ever had this property. It also has the attribute of permissionless value transfer. More than 98% of other cryptocurrencies are centralised and under the auspices of some individual or entity. They are therefore confiscatable. Bitcoin is not a company. It does not have a CEO or a marketing department. There is no off switch anywhere to disable it. It is not a security, i.e., it did not require a company to raise funds towards its development via a VC or ICO. There is no central authority.

The Bitcoin token/currency represented a significant breakthrough in our thinking. It enables an entirely different socio-economic model. Bitcoin introduced utility (payments, smart contracts, etc.) that was not practical without this currency – there are other cryptocurrency networks that can function just as well without the cryptocurrency, and even without a blockchain. For Bitcoin to work, it needs not only the blockchain but the cryptocurrency as an incentive along with a consensus mechanism as well.

Furthermore, this payment utility was enabled solely by the cryptocurrency or token itself and is not tied to the fortunes of any particular company or group of companies whatsoever!! Most ICO startups, however, are not creating new utility, but instead are grafting cryptocurrency and blockchain technology into existing business models. The value of these tokens is tied directly to the success of these firms.