Introduction

Depending on which country you are in, local or domestic payments generally function well and are not too costly. Situations do vary though. So while a consumer paying for goods with a credit or debit/cheque card at a merchant will generally not pay for the transaction, merchants can often be dissatisfied with the card payment acceptance fees charged by their banks. And the consumer’s fee for the transaction will depend on what type of bank account she/he may have.

However, when making payments to other countries, whether paying a supplier via wire-transfer or simply doing online shopping on an international store such as Amazon, the fees for those transactions are generally higher and poorly disclosed.

Regardless of which payment report or survey one reviews, the following issues that business users experience with cross-border payments have persisted, and has not seen much improvement in the last decade:

- Transparency – Users of cross-border payment systems consistently note the difficulty in tracing cross-border payments, especially in predicting when funds would be available to the person or business they are paying.

- Speed – Whereas fast, same day domestic payments are becoming more widespread, seven-day settlement times for some cross-border payments are still real.

- Costs – Cost is a concern to users of cross-border retail payments in two ways: (i) fee transparency (i.e. the ability to know how much a payment will cost before making it) and (ii) the amount charged (i.e. the price charged for services).

Cross-border money transfers or remittances are generally much more costly than domestic retail payments as well. While remittance fees have reduced somewhat over the years, it is still relatively high. The reasons for this are varied, but it all comes down to insufficient integration between payment systems, and the need for multiple intermediaries to facilitate payments between countries. We will explore some of these issues below.

Individual countries’ domestic payments are not geared to handle cross-border payments

Over the past few decades, many countries have established both high and low-value payment systems that are based on proprietary communication and security standards. As a result of this largely independent development efforts, there now is a lack of standardization and automation in inter-bank and even intra-bank networks. This often results in manual intervention to collect, reconcile and repair payment data.

Major banks with subsidiaries, branches and associated banks in other countries may move funds to a destination country by an intra-bank transaction. The beneficiary is either credited directly where it has an account with the foreign operation or the payment is sent to the beneficiary’s bank via a bilateral transfer, or a national clearing and settlement system. Regardless of the mechanism, it is still costly and inefficient due to the use of non-standard customer interfaces, incompatible data formats between domestic and foreign banks, and the low degree of automation in banks’ internal systems.

Le’s explore this in a bit more detail…

… it is still costly and inefficient due to the use of non-standard customer interfaces, incompatible data …

Some technical challenges involved in the processing of cross-border payments.

Disparate Messaging Standards

Electronic payments, whether domestic or cross-border, require the exchange of electronic messages between all the actors involved in a payment. These messages typically identify things such as the payer’s and payee’s account information and the payment amount. Communication between payment service providers (PSPs) and/or payment infrastructure operators is typically conducted via dedicated networks, with SWIFT (Society for Worldwide Interbank Financial Telecommunication) being the largest global network provider. SWIFT has its origins in correspondent banking and connects 11,000 organisations in 200 countries and territories. These organisations exchange more than 23 million structured messages a day via SWIFT’s FIN messaging service.

Messaging can give rise to challenges for cross-border payments if the information originated by the payer’s PSP does not tally, in content or format, with the information required by the payee’s PSP. Such a mismatch may result from a lack of standardisation in messaging formats, or from manual processes that alter the contents or omit or retain specific data elements. It may also arise due to differences in an effort to comply with legal and regulatory requirements (e.g. AML/CFT provisions) for different jurisdictions. A lack of standardisation at the international level, in turn, can arise because payment messaging standards in a given jurisdiction are often developed jointly by PSPs and infrastructure operators in that specific jurisdiction and tailored to the needs of that domestic market rather than broader international payment requirements.

Payment messages that need manual intervention because of different formats naturally incur additional costs and take more time to prepare and process than homogeneous, standardised payment messages. Even cross-border retail payments that are sent using standardised messages in SWIFT and other communication networks might require additional information beyond that permitted by a standard format (e.g. for invoice reconciliation).

Innovation and enhancement of cross-border payment systems has been slow

Resistance to the adoption of standards arises from the large costs associated with enhancing internal systems and procedures relative to the small volume of international payments. Unlike domestic standards, cross-border message standards have to support multiple domestic rules and regulations before they can be adopted within a market. In addition the value of a standard is realized only when the specification is widely accepted. As a result, banks are reluctant to make sizable investments to support such standards if they are uncertain that other banks are making similar investments to upgrade their systems.

… Resistance to the adoption of standards arises from the large costs associated with enhancing internal systems and procedures relative to the small volume of international payments …

Cross-border Payment Clearing and Settlement

Clearing

Clearing is the process of transmitting, reconciling and, in some cases, confirming transactions prior to settlement. Where appropriate, it will include the netting of transactions and the establishment of final positions for settlement. Netting is a key part of clearing that can enhance efficiency and reduce certain risks. Netting can reduce the number of funds transfers that need to take place for settlement, which can in turn lower costs, especially when the transfers are across borders.

Netting cross-border retail payments is an inherently more challenging task than domestic retail payments, as domestic payments are more homogeneous than cross-border ones. Domestic payments are more likely to be largely standardised in terms of message format, currency and timing (e.g. peak volumes are likely to be predictable). Cross-border retail payments may be in different message formats, different currencies and spread out across a broader time period (as time zones extend beyond one jurisdiction) and many different PSPs.

Settlement

Correspondent Banking

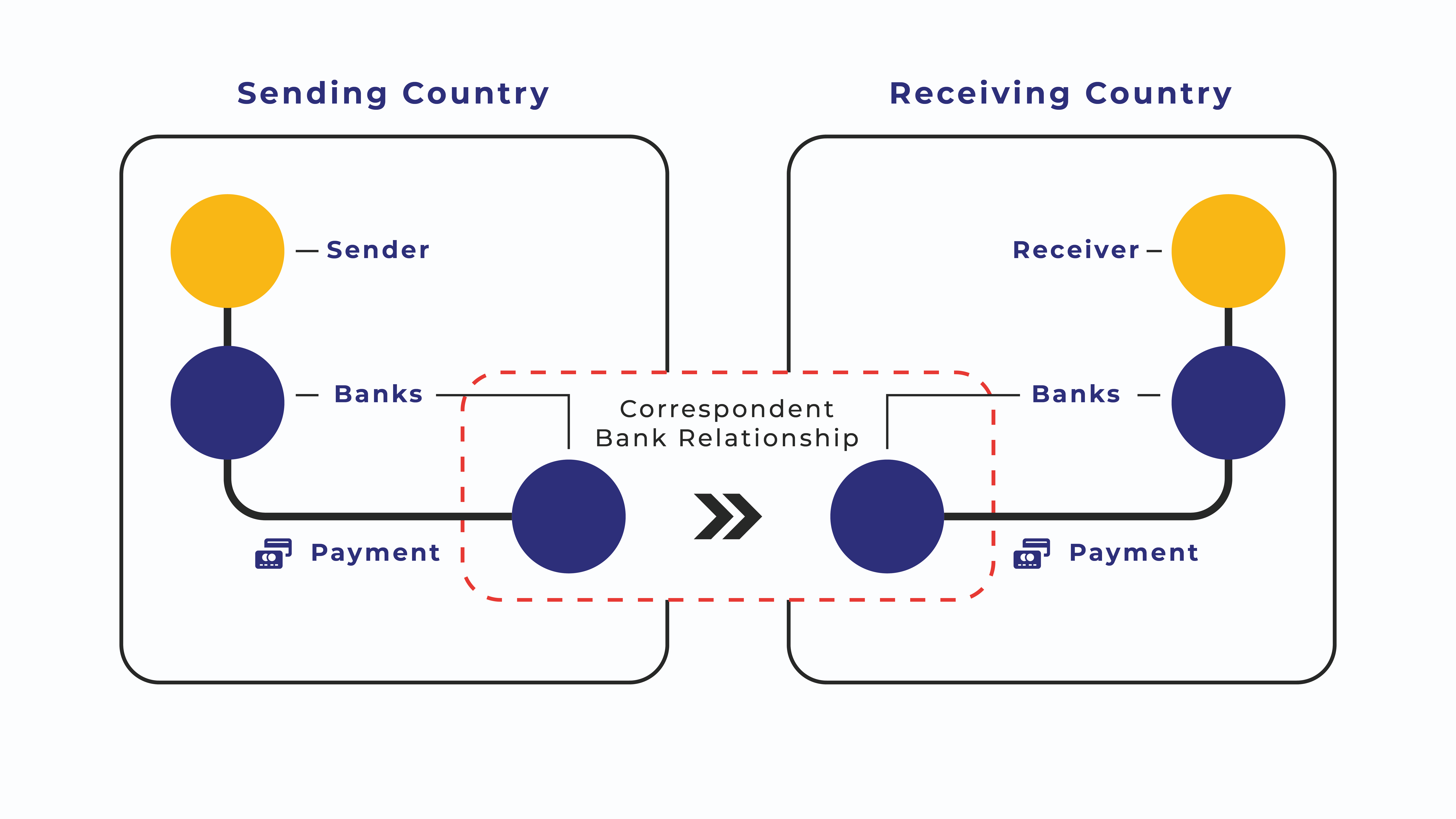

International payments between banks that do not have an established financial relationship and the necessary contractual arrangements for processing payments, typically go through a correspondent bank or banks. When agreements are not in place between the bank sending funds and the one receiving it, a correspondent bank must act as an intermediary. For example, a bank in Chicago that has received instructions from a client to send funds to a bank in Australia cannot send funds directly without a working relationship with the receiving bank.

Most international wire transfers are executed through the SWIFT network. The originating bank can search the SWIFT network for a correspondent bank that has arrangements with itself and the destination bank. Upon finding a correspondent bank having arrangements with both sides of the transfer, the originating bank sends the transferred funds to its account held at the correspondent bank. The correspondent bank deducts its transfer fee, and transfers the funds to the receiving bank in Australia.

In practice, a series of correspondent banking relationships might be involved in a single payment transaction, thereby increasing the complexity, cost and processing time of the transaction. A frequently overlooked aspect of international payments is the currency spread.

Small and medium sized B2B exporters usually don’t have much negotiating power when it comes to a bank’s conversion rate. For example, when exporting from India to Europe the importer will in almost all cases go to their bank and initiate a payment. This usually has a fixed cost of around 30€. When asked, the local bank will claim there are no extra costs, which on the surface is true. But upon deeper inspection, you will see that the difference between the mid-market rate and the buy rate for Indian rupees is at least 3%, often as much as 6%. If the invoice and contracts are specified in Euros, then this becomes an additional cost that the Indian exporter will have to bear.

Therefore, if your business operates transnationally, within countries that have illiquid currency pairs, you should find the most optimal payment solution that allows you to minimise the costs of international money transfers.

Alternatives to Correspondent Banking

An alternative to the traditional correspondent banking model is the interlinking between the national payment infrastructures of two different countries. Such a link can be established by the private or public sectors between the automated clearing houses (ACHs) or real-time gross settlement (RTGS) systems of different countries. It would allow PSPs from country A participating in the payment infrastructure of country A to send payments to PSPs from country B participating in country B’s payment infrastructure. As discussed above, where infrastructures settle in different currencies, arrangements will need to accommodate foreign exchange transactions.

Cross-border Card Payments

A payer can make a payment in person when abroad or, from home, a payment to an online merchant based abroad. Alongside global and regional online e-money schemes, payment cards are the main payment instrument available for cross-border e-commerce, whereas for domestic e-commerce a wider variety of payment mechanisms and cash are usually available. At the back end, for payments that occur within a card network, an interbank payment card processing network (e.g. Visa) and platform (e.g. VisaNet) connects various payment card issuers and acquiring banks. It allows the exchange of payment card transactions by a bank’s cardholder with another bank’s merchant, automated teller machine (ATM) or other card acceptance device, provided that both banks belong to the same scheme (i.e. adhere to the same set of business rules and technical standards) and the same platform.

While there are specialised card processors, major international card networks such as Visa or Mastercard typically offer processing services for domestic and cross-border transactions, and the latter are often exclusively processed via the processing platform associated with the card network. Interbank settlement of cross-border card transactions typically relies on traditional correspondent banking, although not on a bilateral basis between the issuing and the acquiring banks, but rather by relying on the international card network to establish a multilateral net position that (issuing) banks have to settle by crediting the account that the international card network holds at its settlement bank. Foreign exchange conversions may also be required.

Cross-border Remittances

… an interbank payment card processing network (e.g. Visa) and platform (e.g. VisaNet) connects various payment card issuers and acquiring banks …

… Interbank settlement of cross-border card transactions typically relies on traditional correspondent banking …

According to the International Fund for Agricultural Development (IFAD), over 3,000 MTOs operate worldwide, but many of them are small and focus on a limited number of countries. At the same time, five MTOs are reported to have a combined market share of 35% in the international remittance market.

Of major concern here is that the lower-value remittances often have higher fees associated with them. Furthermore, the ‘hidden’ fees that result from currency conversion or spread is very often overlooked or not understood. The difference between the buy and sell rate of a currency is known as a spread. For instance, to buy one Euro you may have to spend 1.16 USD but when you sell one euro you only get 1.10 USD. This means the spread is 0.06 USD, or 5.3%.

The liquidity of a currency pair is the biggest deciding factor that influences a currency pair’s spread. Liquidity in the currency market refers to the degree to which a currency can be quickly bought or sold in the market without affecting the currency’s current market price.

The more liquid a currency pair, the easier it is to transfer large amounts from one currency into the other without moving the market price of the currency, so the tighter its spread will be. On the other hand, the less liquid a currency pair, the harder it becomes to exchange large volumes of one currency for another without moving the market price against you. Therefore, those spreads will be wider and it will be more expensive for you to exchange currency are transfer money internationally.

… the less liquid a currency pair, the harder it becomes to exchange large volumes of one currency for another without moving the market …

Therefore, those spreads will be wider and it will be more expensive for you to exchange currency …

The four most liquid currency pairs, i.e. the ones that trade the most (ranked by daily traded volume) are the EUR/USD, USD/JPY, GBP/USD and USD/CHF. These four currency pairs are known as ‘the majors’. The next most liquid pairs are the AUD/USD, USD/CAD and NZD/USD. They are often referred to as the ‘commodity currency pairs’ as these are currencies of commodity-driven economies.

The above mentioned seven currency pairs constitute around 85% of daily trading volumes in the global currency market.

In the remaining 15% of daily traded volumes you find currencies such as the South African Rand (ZAR), the Mexican Peso (MXN), the Russian Ruble (RUB), the Swedish Krona (SEK) and the Norwegian Krone (NOK), and of course the Asian currencies such as the Chinese Yuan (CNY), the Hong Kong Dollar (KHD), the South Korean Won (KRW), the Singapore Dollar (SGD) and the Indian Rupee (INR).

The overall costs of transferring money between countries between which the currency pairs are thinly traded are therefore higher.