Introduction.

Bitcoin as a form of money exhibits unique features that are counter-intuitive for most of us, given our everyday experience with money. It is borderless money. It is programmable money. It is money that cannot be confiscated or seized by governments. It is money that falls outside of any regulatory and legal framework humanity has devised to date. How is it possible that bitcoins cannot be regulated, restricted, controlled, seized or otherwise censored by any government?

How is it possible that bitcoins do not fit into the conventional notions of country borders and are immune to foreign exchange or currency control regulations?

To answer these questions, we’ll first need to revisit the Bitcoin blockchain and the nature of bitcoin transactions. Thereafter, we can illustrate the real-world applications and geopolitical ramifications of this new currency.

Bitcoin Review

The Bitcoin network is not owned or controlled by a central authority or organization

Recall that the Bitcoin payment network is a peer-to-peer network within which transactions are broadcast and eventually added to a blockchain that is maintained by the nodes of that network. This network is not owned or controlled by any authority. There is no legal entity that owns or backs this network or otherwise influences its development path. It is no exaggeration to say that the only way to shut down the Bitcoin network is to shut down the Internet.

“How is it possible that bitcoins cannot be regulated, restricted, controlled, seized or otherwise censored by any government?”

Bitcoins live outside of our geographical world of country borders and jurisdictions

Bitcoins do not have a physical location. Bitcoins live on the blockchain, which is a global, decentralized, jurisdiction-agnostic database. The blockchain is global, and even though a physical location is nonsensical in a virtual world of bitcoin addresses, you can think of the bitcoins as already being ‘everywhere’.

Bitcoin wallet software gives the impression that satoshis are sent from and to wallets, but bitcoins really move from transaction to transaction, and these transactions are stored on global blockchain. Each transaction spends the satoshis previously received in one or more earlier transactions, so the input of one transaction is the output of a previous transaction. The outputs of a bitcoin transaction effectively specifies the number of satoshis available to be spent, and who is able to spend it. Only someone with the right public/private key pair will be able to unlock the bitcoins in the output and spend it onward.

Furthermore, even though your wallet gives you the impression that you have a certain number of bitcoins on your mobile device or hardware wallet, you do not actually have those bitcoins. What you have are the cryptographic keys that enable you to spend bitcoins that are locked up in a transaction output that is stored on the blockchain. So if you and your hardware wallet move between countries, you are not taking ‘bitcoin money’ with you across the border. To be technically correct, there is no such thing as transmitting or physically moving money in the world of Bitcoin. When you and your hardware wallet travel to another country, the unspent transaction outputs are already ‘there’. It is already ‘everywhere’.

Bitcoins are therefore always global, and when you transact with or ‘send’ bitcoins to another recipient, all you are doing is declaring a change of ownership (which is validated by the entire network) of the bitcoins that is on this global network. The bitcoins themselves do not actually move in any physical sense.

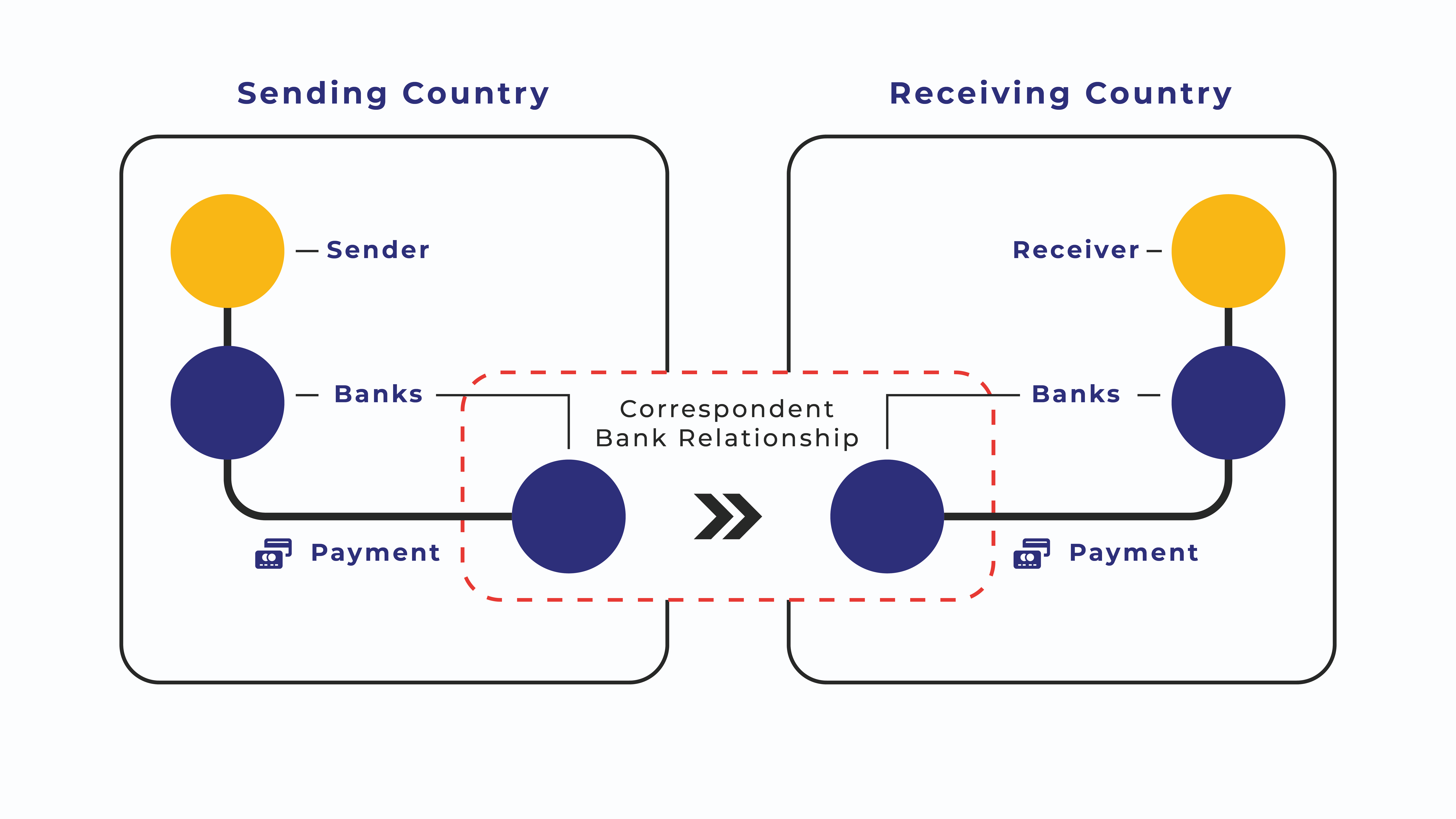

Therefore, all the laws and legal frameworks around money transmission (such as those for Money Transfer Operators) becomes completely obsolete and redundant because with Bitcoin we are not transmitting money!

Transmission of bitcoin transactions can be done outside of the Bitcoin network

Bitcoins are a form of money that is completely independent of the underlying transport medium. A bitcoin transaction is a digitally signed data structure that can be transmitted on various transport layers or communication media such as email, SMS or Facebook, not just the Bitcoin payment network. All the transaction needs to do is reach the miners somehow to eventually be included in a block.

Furthermore, the communication medium does not even have to be secure because there is nothing sensitive in the bitcoin transaction itself. The security of the bitcoin transaction comes from the rightful ownership of the public/private keys and the proof-of-work consensus mechanism.

In contrast with say a credit card transaction at a point of sale device, your actual credit card details (card number, expiry date, CVV code, etc.) is what is being transmitted via the device and all the intermediaries until it gets to the card-issuing bank for authorization. That information is sensitive, and if it was intercepted and decrypted somehow, the credit card holder’s account would be compromised. Stringent PCI DSS (Payment Card Industry Data Security Standards) implementations are meant to minimize this risk, but the point is that unlike a bitcoin transaction, what you are transmitting to the issuing bank is the actual sensitive data.

Credit card information is also stored at various points along the payment chains. And we have seen numerous examples of how card information has been compromised. Not always because the participants in the payment chain have been delinquent, but because a sufficiently motivated hacker or criminal will eventually find a way to obtain this information. Credit card data effectively are the access codes to your accounts.

Bitcoin transactions are fundamentally different. The transactions that are being transmitted are not the ‘access codes’, just digitally signed messages. The transaction is an authorization for who can spend an unspent transaction output on the blockchain. The transaction contains no sensitive data. If you intercept this transaction, all you will know is which address the money is coming from, which address is able to spend it, and how much can be spent. The signatures reveal nothing. The addresses reveal nothing. Even if you did intercept the transaction, you cannot modify the transaction because every part of it is included in the signature (technically, Bitcoin allows parties to a smart contract to modify certain parts of a transaction using SIGHASH flags and ANYONECANPAY modifiers).

Therefore this transaction can be transmitted via any unsecured communication medium. Nothing in the message can be compromised. The transaction is separate from the transmission medium so that it does not depend on any underlying security. All we need is for the message to reach one node in the bitcoin network. From there it will be propagated to other nodes and validated by the network.

Bitcoin transactions can be converted into any message type

Bitcoin transactions are data structures. As such, transactions can be encoded into different formats such as pictures that can be emailed to a recipient, or posted on a web page to be accessed by a recipient. The recipient simply needs to decode the new file format to obtain the original transaction and inject it into the Bitcoin network for mining. Bitcoin transactions could even be hidden inside images that can be sent to recipients via any convenient communication tool.

Why can bitcoin transactions not be banned or blocked by tyrannical governments?

Because bitcoin transactions are non-compromising data structures that can be transmitted in various formats, using a variety of communication mechanisms at our disposal, it is not practically possible to ban bitcoin transactions or to place cross-border restrictions on them.

Bitcoin therefore is a type of money, the ‘transmission’ of which no different to the transmission of data. Today, we have too many interconnected communication mechanisms for any authority to even attempt blocking the transmission of bitcoin transactions.

This also has implications for underdeveloped economies where Internet connectivity is lacking, but where radio or SMS/GSM can be used.