Overview

An inordinate amount of money has flowed into blockchain startups via their token sales (ICOs) in the last year or so, way beyond what makes business sense. In addition to the vast sums of money poured into the purchasing of tokens before or during the ICO, the tokens themselves are now trading at prices well beyond what they were initially sold for during those ICOs. The ICO phenomenon has effectively become an abused, unregulated mechanism that siphons money from inexperienced or uninformed investors to the token-issuers based on hype and FOMO, rather than a well-grounded fundraising process. This creates a precarious situation for existing and potential cryptocurrency investors, as well as aspiring ICO projects.

Furthermore, the cryptocurrency space is an extremely divided, contested and adversarial one, with fierce technology debates continuously raging. The mere mention of the risks attached to Ethereum (discussed further below) will immediately trigger emotive retaliation rather than constructive conversations. But if the vast majority of exchange-traded tokens and a major component of the cryptocurrency market cap is tied to the success of Ethereum, it is crucial to evaluate this platform objectively.

There are those cryptocurrency experts who draw parallels between the recent “ICO hype” and the IPO hype that preceded the dot-com crash. These parallels are indeed well-founded. It was only with hindsight that business cases for these dotcom startups were recognized as weak. The same narrative is playing out right now. Furthermore, the majority of the investors in and owners of, blockchain startups that are raising capital via ICOs, either were not exposed to the dot-com crash, or witnessed it without suffering financial losses. We might therefore repeat the same mistakes.

ICO Advisory firms are more experienced in technology and finance without the necessary business acumen

There are some credible consultants and investment managers in the cryptocurrency space who will advise/assist their tech startup clients through an ICO, or guide/manage their clients’ holdings in cryptocurrencies. For example, the valuations from Multicoin Capital are generally very professional and well thought through. However, their valuations (and those of others) usually have a strong focus on the technological advantages of the solutions, which is reflective of the overall mindset in this sector. Valuations can be improved upon by placing more focus on the long-term sustainability of the businesses powered by these tokens. If this is done, a different set of recommendations would likely follow, as will be expanded upon below.

…it is more important to have a customer-led strategy than a product-led strategy. These tech startups are predominantly taking a ‘product push’ approach

The makeup of many advisory teams around the globe is generally weighted towards engineers, computer scientists and other ‘hard science’ professionals

So for example, when a firm such as The Element Group evaluate the investment potential of a new startup, they would offer the usual guidance such as making sure that the teams are not looking for a problem to solve using their blockchain tools, which is a good thing. This is not enough though. Other advisors, using their previous fundraising experience will assist startups to run successful ICO’s. Others, such as ICO Mission Control by Quoine, are building platforms to facilitate a simpler and smoother ICO process that is currently rather cumbersome. The technology bias of some of these advisory firms is so strong that they will even market their AI capabilities as a competitive advantage that ensures their clients get the best investment returns from their crypto holdings. These are examples of where the ‘experts’ on whom so many of us rely on, are focusing on the wrong problems. The technology alone will not ensure success. The fundamental long-term sustainability of the business takes second place in the race to capitalize on the ICO phenomenon.

The kinds of issues that advisors and investors need to challenge more than the technology include:

- Has the market demand for the product been thoroughly assessed and validated?

- How big (actual numbers) is the market for this product, now and over the next 5–10 years?

- Who are the competitors? What are their unique value propositions? What are their strengths and weaknesses? What will be the unique value proposition to fend off these competitors once you are live?

- What sales and distribution strategy and tactics will be adopted to drive take-up? This needs to be detailed and include sales volumes, by distribution channel, for each at least every 6 months over the next 3–5 years. Just having a strong team of developers and engineers is not going to sell your product.

- What are the customer volumes, revenues and cost projections (in detail) over the next 3–5 years? ICO valuations tend to steer clear of this aspect, because it is too difficult to estimate. This cannot be an excuse. If it was easy, anyone could do it.

- How much of the money raised through the token sale will be used for marketing the product or value proposition? What will be your marketing tactics and what do you anticipate your marketing ROI to be?

- What techniques will you adopt to drive customers from their current service providers to your offering? Or to stimulate demand from new customers? etc.

It is more important to ask the above questions, than to assess a token on the merits of its technology. Answers to the above questions, or at least an attempt to answer the questions will provide more clarity about the long-term sustainability of the startup. This however has not been the approach to date. This is one of many reasons why these startups are unlikely to succeed.

Furthermore, virtually every seasoned management consultant or executive in business today knows that it is more important to have a customer-led strategy than a product-led strategy. These tech startups are predominantly taking a ‘product push’ approach. Unless you are seasoned in the running of a business in a competitive environment, you will not understand how difficult it is to change customer behavior or get them to switch to your solution from that of your competitor. You will not understand how difficult it is to optimize you marketing ROI given all the marketing clutter out there. You will not understand how to optimize your sales and pipeline strategies to drive customer take-up and sales volumes of your solutions. Very little of this business-related thinking is or was taking place in the ICO space. As traditional or outdated as this may appear to the newer generation of startups, these are essential basics without which businesses are unlikely to flourish.

The disconnect between the amount of funds raised and the long-term value of the startups

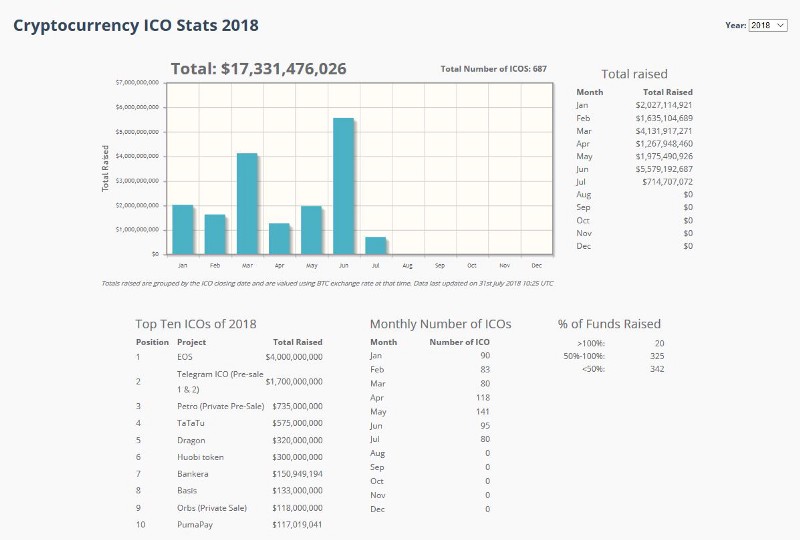

There is a massive disconnect between the amount of money that has been raised during ICOs, and the real business value that the majority of startups will eventually generate. Some poignant examples that illustrate this include EOS and Telegram, who each raised around $4bn and $1.7bn respectively. This staggeringly large amount of money was predominantly funded by retail investors and was done before the startup was even able to build a track record or to demonstrate real business value. What kind of amazing business plan was presented to the investors to justify this amount of investment?

On average, you will find that decent business plans for ICOs are scant to non-existent. It is not enough to see a very thorough whitepaper, but complementary information such as a market gap analysis, competitor analysis, SWOT analysis, a financial model, wallet design, and more as described above. Many potential investors look at the white papers, the teams behind the startup, or listen to other ‘experts’ to decide on whether to invest. This is where the parallels between the dotcom bubble and the ICO bubble have merit. Back then, just because businesses or startups had a website, their valuations skyrocketed despite the fact that there was no solid business case to justify such high valuations. Similarly today, just because a business is built on a blockchain, it’s value becomes irrationally high.

Let’s consider just a few random examples of tokens. These were chosen because information about them were readily available, and for no other reason:

- EOS

- Augur

- Golem

Let’s briefly look at these individually.

EOS

By June 2018, EOS raised roughly $4.1bn, but it only went live around the same time. This is a massive amount of money for a startup that did not even have a minimal viable product. At the time of writing, the daily active user count for the last month was only 32! The EOS whitepaper is rather technical and has no go-to-market strategy or answers to the above questions. Multicoin Capital produced a valuation report which was reasonably thorough. The report rightly points out the fundamental weaknesses of Ethereum, which is also elaborated upon below. It also makes some consideration for the competitive landscape. However, it too was unable to answer the fundamental questions about the long-term business sustainability of this business. A quote from the report supports this view: “Attempting to value EOS is much different than trying to value other projects. In our valuations of projects like Augur and Factom, we were able to construct clear valuation models based on a net present value (NPV) model or a supply and demand equilibrium model, respectively. With EOS, this is simply not feasible given the underlying token mechanics. The EOS model is unique among all token models.”.

There were many other issues with the year-long ICO process for EOS. This is a separate discussion altogether, but is mentioned to raise awareness of additional shenanigans in this industry and the additional (but unknown) risks that investors are exposed to, beyond just the disparity between the funds raised and the actual business value.

Augur

Augur’s token sale took place between August and September 2015 and raised $5.3m USD. But the solution only went live mid-2018. The amount is not as extreme as EOS, but it is still a massive amount of startup funding for what essentially was a concept. The whitepaper is EXTREMELY complicated, technical and mathematical. How would an investor be able to make an investment decision on the basis of this paper? And at the time of writing, Augur has less than 30 active daily users!

The Multicoin Capital valuation rightly raises the risk that “the success of Augur as a user-facing application is directly tied to the success of Ethereum”. The report also included some financial modelling which is good. However, the underlying sales, marketing and distribution strategies that would enable the projected numbers to be reached are absent. Surely this is not enough to provide a savvy investor with confidence that the targeted projections will be reached? The underlying costs for the application will also be impacted by the (in)efficiencies of the Ethereum platform, which also adds to the risk of this investment.

An additional side-note regarding Augur, is that the original developer of the idea, who is fairly well respected and credible, does not agree that the way Augur was built will ensure its longer-term survival. Again, this is separate conversation but is also mentioned to raise awareness of the controversy and conflicting views in this space. This makes it extremely difficult for ordinary investors to make sound decisions.

Golem

Golem conducted the sale of its tokens in November 2016 and raised about $8.6m USD. However, the first phase of the solution only went live in April 2018. The final phase of the solution is currently estimated for late 2020. Again, this is similar to the previous examples where large sums of money were secured for a technical concept without a proper business case.

This particular white paper was interesting though. It actually had a go-to-market (GMS) strategy along with a roadmap for how the solution would be rolled out, which is a great start. However, the GMS is extremely light, and focusses more on developers than the end user. There is no robust analysis for what the anticipated market demand for this offering would be. And if there is a market for it, at what sorts of price points? It should therefore be no surprise that in the last month the daily active user count was just above 200.

Closing remarks…

The majority of the businesses that are funded via ICO’s follow normal business models, and from a practical perspective do not even need to be built on top of a blockchain. The desired decentralization and censorship resistance comes with many other disadvantages that reduces their ability to compete with normal, centralized business models. It is very different to Bitcoin where something new, that never existed before was created, namely trustless peer-to-peer payments. The bitcoin token is intrinsic to and necessary for the functioning of the network. Bitcoin was a significant advancement to the state of payments and introduced utility that was not practical without the token. Furthermore, this utility was enabled solely by the token and its value is not tied to the fortunes of any particular company or foundation. Most ICO startups however, are not creating new utility. Rather, they are forcing ‘square peg’ cryptocurrencies and blockchains into traditional ‘round hole’ business models, and the value of these tokens is tied directly to the success of these firms. The proper valuation of these businesses therefore cannot be ignored.

The valuations for these startups are extremely ambitious considering that for the most part, they do not have functional products or significant business and industry experience. ICO investors are simply blinded by blockchain technology and are paying a premium for companies that may be run by very smart but unproven teams. Blockchain technology, ICOs and tech startups are not immune to fundamental economics. These tech startups are entering existing markets (possibly with established competition) that can be run more profitably on a centralized basis, and they will be at a significant competitive disadvantage to these firms. The technology alone will not ensure success. You need consumer adoption, at scale, at the right price points and you need to have savvy to fend off competition.

There are clearly speculative profits to be made by buying tokens during or before the ICO and selling them before the company begins operations and real-world economics take effect. In the long run though, the value of almost all these tokens will be driven to zero.