Bitcoin is still not feasible as a means of payment…

For some time now, Bitcoin has been seen as unusable as a means of payment. This is predominantly because of the following:

- Even though Bitcoin was built to act as peer-to-peer digital cash, it has instead become a “store of value” or speculative instrument for many and is regularly referred to as digital gold.

- The bitcoin price has been very volatile, transaction fees were high, and transaction settlement time frames on the Bitcoin blockchain were too long.

Transaction time frames would vary depending on blockchain activity, and transactions could go hours without being confirmed. According to payment gateway providers, spending too little to confirm the transaction would result in a payment transaction expiring, with the Bitcoin transaction succeeding much later, and frustration for the buyer as well as lost fees which cannot be recouped.

Fortunately, these transactional problems are being addressed with the introduction of Segwit transactions and the Lightning Protocol, or Lightning Network as it is frequently referred to as. Lightning is a protocol for making fast bitcoin payments, or even micropayments with minimal fees, using a network of payment channels that operate on top of the Bitcoin Blockchain.

The borderless nature of Bitcoin lends itself really well for cross-border payments. But until such time as the price volatility stabilizes, bitcoins will not gain wide acceptance as a means of payment.

… But existing cross-border payment systems are problematic as well

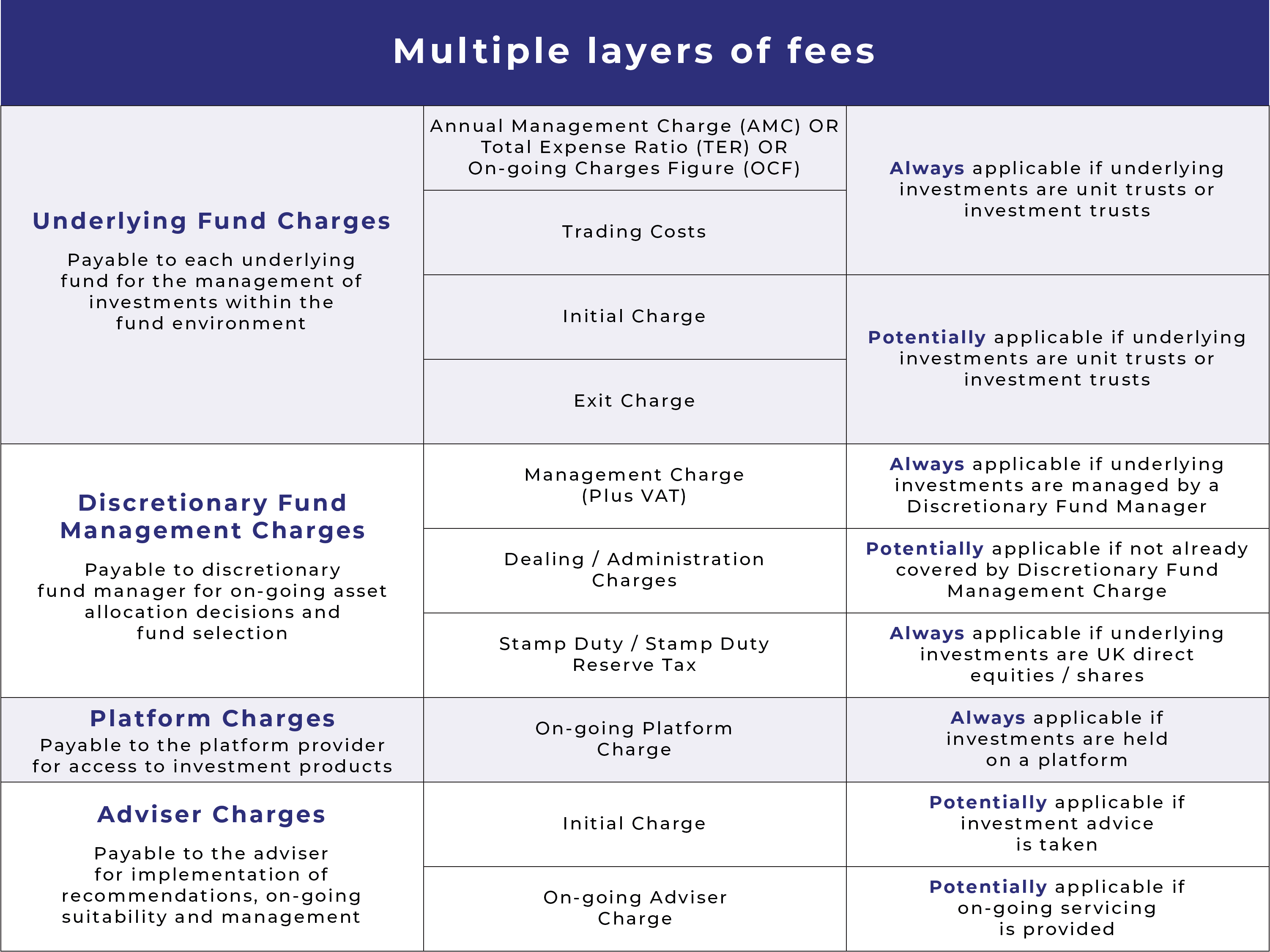

Cross-border payment volumes are massive. B2B transactions exceed $24 Trillion per annum, with fees being in the region of up to 40 times higher than transaction fees for domestic payments. Furthermore, even though settlement times have on average steadily reduced over the years, settlement times of around 5 days are still common. The overall reason for this is because of the lack of enough integrations between the national payment systems of different countries.

Remittance payments, although small compared to cross-border corporate payments, are expected to exceed $600bn in 2018, with transaction fees being much higher by comparison.

Cross-border corporate (B2B) payments

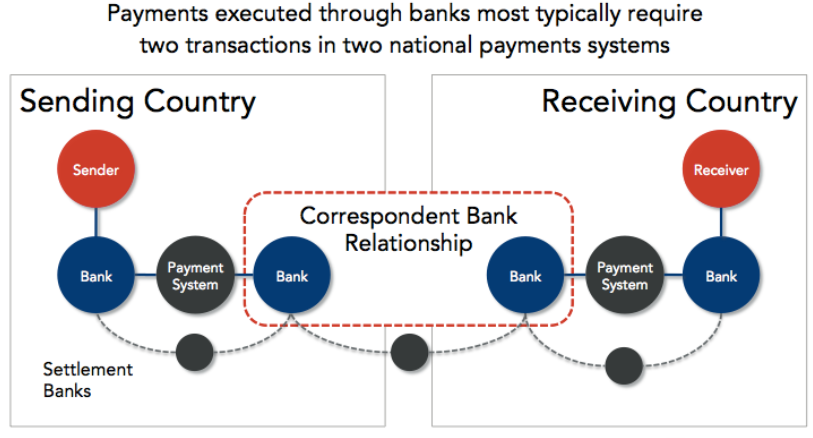

Cross-border B2B payments typically make use of the correspondent banking model, illustrated in the diagram below:

One of the big enablers for this complex system is the SWIFT communication network. SWIFT is not a payments system, but rather a standardized messaging system that banks around the world use to tell each other what they have done and what they want to be done with these types of transactions. SWIFT provides the message codes and protocols that help banks understand the transaction that they receive to act accordingly. SWIFT is a cooperative owned by its member banks.

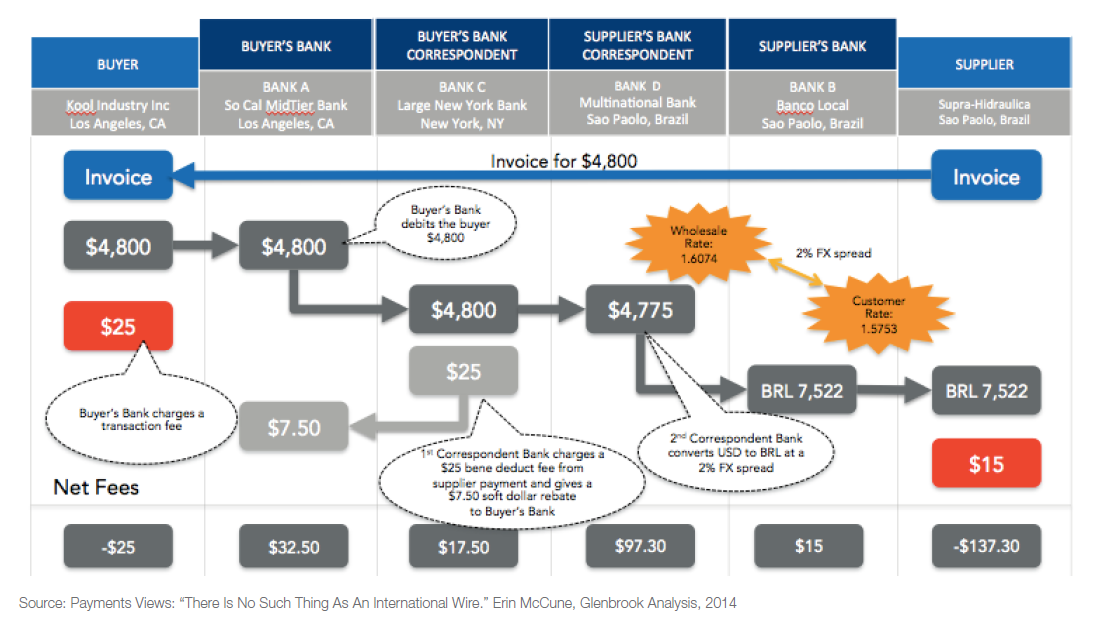

In practice, multiple correspondent banks may be involved in the processing of a single payment. With so many intermediaries involved in processing a cross-border payment, the overall fees can become quite high. The following diagram aptly illustrates this:

The ways these payments are made can be cumbersome, error-prone, and expensive. While alternative cross-border payment mechanisms (such as payment card networks) do exist, these payments systems that were set up decades ago continue to be used. New business requirements are usually force-fitted, or the systems are sometimes retrofitted to meet the needs of modern businesses.

And, it is common for these legacy systems to take major strain. For corporate treasurers and other users of these systems, on both the paying and receiving sides, it can be difficult and time consuming to learn how to use cross-border payments tools, and how to set up processes to make optimal use of them. Solution providers (both banks and non-banks) also face challenges of having to cobble together old systems with new technology to meet additional demands. But for these providers, cross-border payments are both lucrative (especially given foreign exchange conversion revenue) and rewarding, in terms of the overall financial relationship created with the end customer.

Remittance payments

On average, the charge for sending $200―the benchmark used by authorities to evaluate cost―is $14. That is, the combination of fees (including charges from both the sender and recipient intermediaries) and the exchange rate margin typically eats up fully 7% of the amount sent. It is less expensive to send larger amounts, with the global average cost of sending $500 at just under 5%. Even so, the aggregate cost of sending remittances in 2017 was about US$30 billion, roughly equivalent to the total non-military foreign aid budget of the United States!

With the implementation of the lightning network, Bitcoin now is in a position to effectively compete with traditional cross-border payment systems.

Where to from here?

If Bitcoin is not ready for widespread use as a means of payment and money, and the existing fiat monetary payment systems are so problematic, what other options are left?

We, at SIOTech World, understand the value of Bitcoin technology, and the power that its borderless, censorship-resistant attributes can bring to everyone that works with everyday fiat money. We are focussed on leveraging the technology behind Bitcoin, not the price of the currency. In this regard, we have begun working on a solution that will leverage its technology to improve cross-border payments for everyone around the world.